As global markets navigate the challenges of rising U.S. Treasury yields and mixed economic signals, investors are increasingly focused on growth stocks that have demonstrated resilience amid these fluctuations. In this context, companies with high insider ownership can be particularly appealing, as they often reflect a strong alignment between management and shareholder interests, potentially offering stability in uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.5% | 24.6% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Pharma Mar (BME:PHM) | 11.8% | 49% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We're going to check out a few of the best picks from our screener tool.

Praj Industries (NSEI:PRAJIND)

Simply Wall St Growth Rating: ★★★★★★

Overview: Praj Industries Limited is engaged in bio-based technologies and engineering on a global scale, with a market cap of ₹131.50 billion.

Operations: The company's revenue primarily comes from its Process and Project Engineering segment, amounting to ₹33.63 billion.

Insider Ownership: 29.0%

Earnings Growth Forecast: 23.4% p.a.

Praj Industries has demonstrated robust growth potential, with earnings expected to rise by 23.4% annually, outpacing the Indian market's forecast. Despite recent declines in quarterly revenue and net income, the company remains focused on innovation, as evidenced by its new biopolymers facility in Pune. Insider ownership is significant with no substantial selling over the past quarter, indicating confidence in future prospects. However, its dividend track record remains unstable.

- Delve into the full analysis future growth report here for a deeper understanding of Praj Industries.

- Our valuation report here indicates Praj Industries may be overvalued.

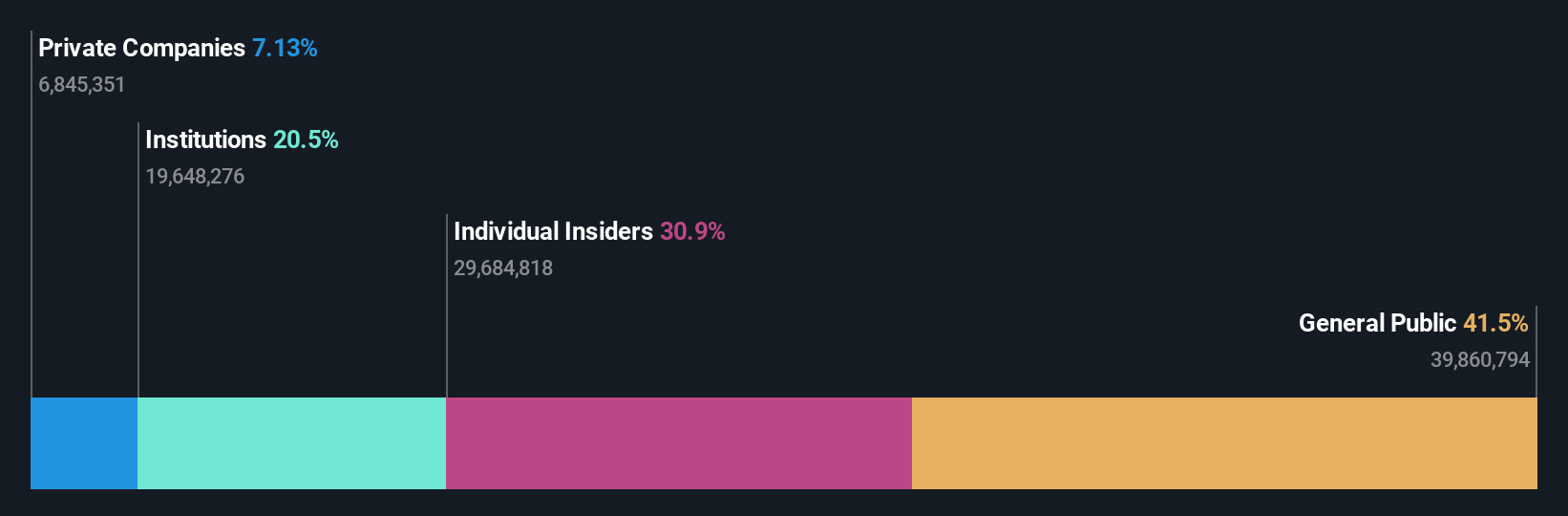

Rianlon (SZSE:300596)

Simply Wall St Growth Rating: ★★★★☆☆

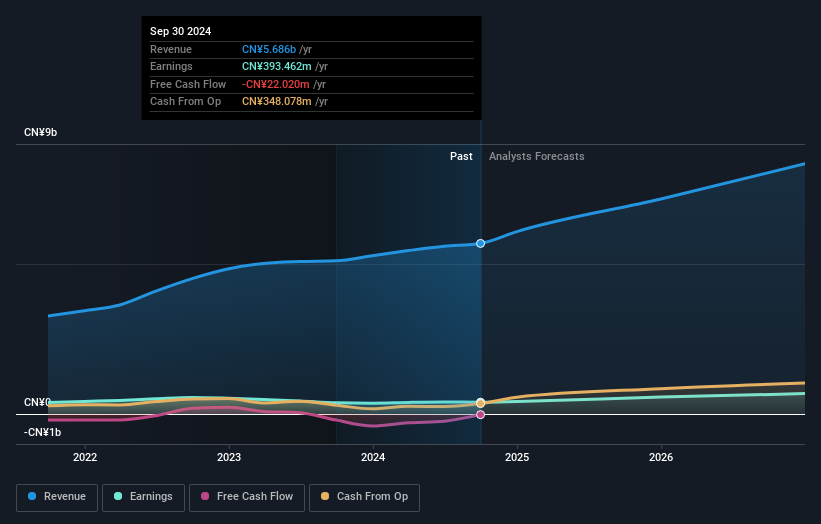

Overview: Rianlon Corporation offers anti-aging additives and application technologies for the global polymer materials industry, with a market cap of CN¥6.36 billion.

Operations: Rianlon Corporation's revenue segments include anti-aging additives and application technologies for the polymer materials industry globally.

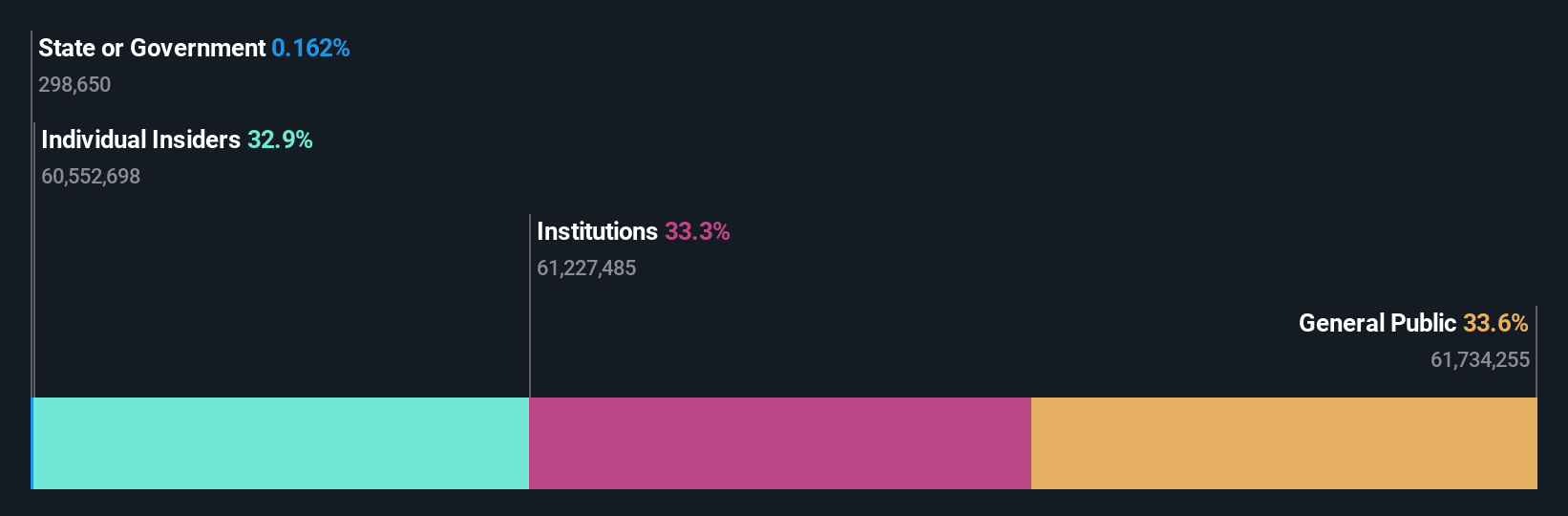

Insider Ownership: 13.8%

Earnings Growth Forecast: 25.2% p.a.

Rianlon's recent earnings report shows a steady increase in sales and net income, with CNY 4.27 billion in sales for the first nine months of 2024. Earnings per share also improved year-over-year. The company's revenue is projected to grow at 17% annually, surpassing the broader Chinese market growth rate. Despite its low price-to-earnings ratio suggesting good value, insider ownership remains high without significant trading activity recently, reflecting confidence in Rianlon's growth trajectory.

- Click here to discover the nuances of Rianlon with our detailed analytical future growth report.

- Our valuation report unveils the possibility Rianlon's shares may be trading at a discount.

Gudeng Precision Industrial (TPEX:3680)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gudeng Precision Industrial Co., Ltd. offers technology services globally and has a market cap of NT$51.19 billion.

Operations: The company's revenue is primarily derived from semiconductor manufacturing, contributing NT$4.45 billion, and semiconductor equipment manufacturing, which accounts for NT$1.26 billion.

Insider Ownership: 31.3%

Earnings Growth Forecast: 36.8% p.a.

Gudeng Precision Industrial reported strong Q2 2024 results, with sales rising to TWD 1.76 billion and net income increasing to TWD 282.63 million year-over-year. Despite past shareholder dilution, the company's revenue is forecasted to grow at a robust rate of 27.8% annually, outpacing the Taiwanese market average of 12.1%. Earnings are expected to increase significantly by 36.8% per year, indicating a promising growth trajectory supported by high insider ownership and no recent substantial trading activity.

- Dive into the specifics of Gudeng Precision Industrial here with our thorough growth forecast report.

- According our valuation report, there's an indication that Gudeng Precision Industrial's share price might be on the expensive side.

Turning Ideas Into Actions

- Dive into all 1466 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300596

Rianlon

Provides anti-aging additives and application technologies for polymer materials industry worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives