- India

- /

- Healthcare Services

- /

- NSEI:HCG

Insider-Owned Growth Giants On The Indian Exchange In July 2024

Reviewed by Simply Wall St

In the past year, the Indian stock market has shown remarkable growth, rising by 45%, although it remained flat over the last week. Against this backdrop of robust annual growth and promising earnings forecasts, companies with high insider ownership can be particularly compelling, as they often reflect a deep commitment from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 30.3% | 28.0% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 29.8% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 34.5% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Let's dive into some prime choices out of from the screener.

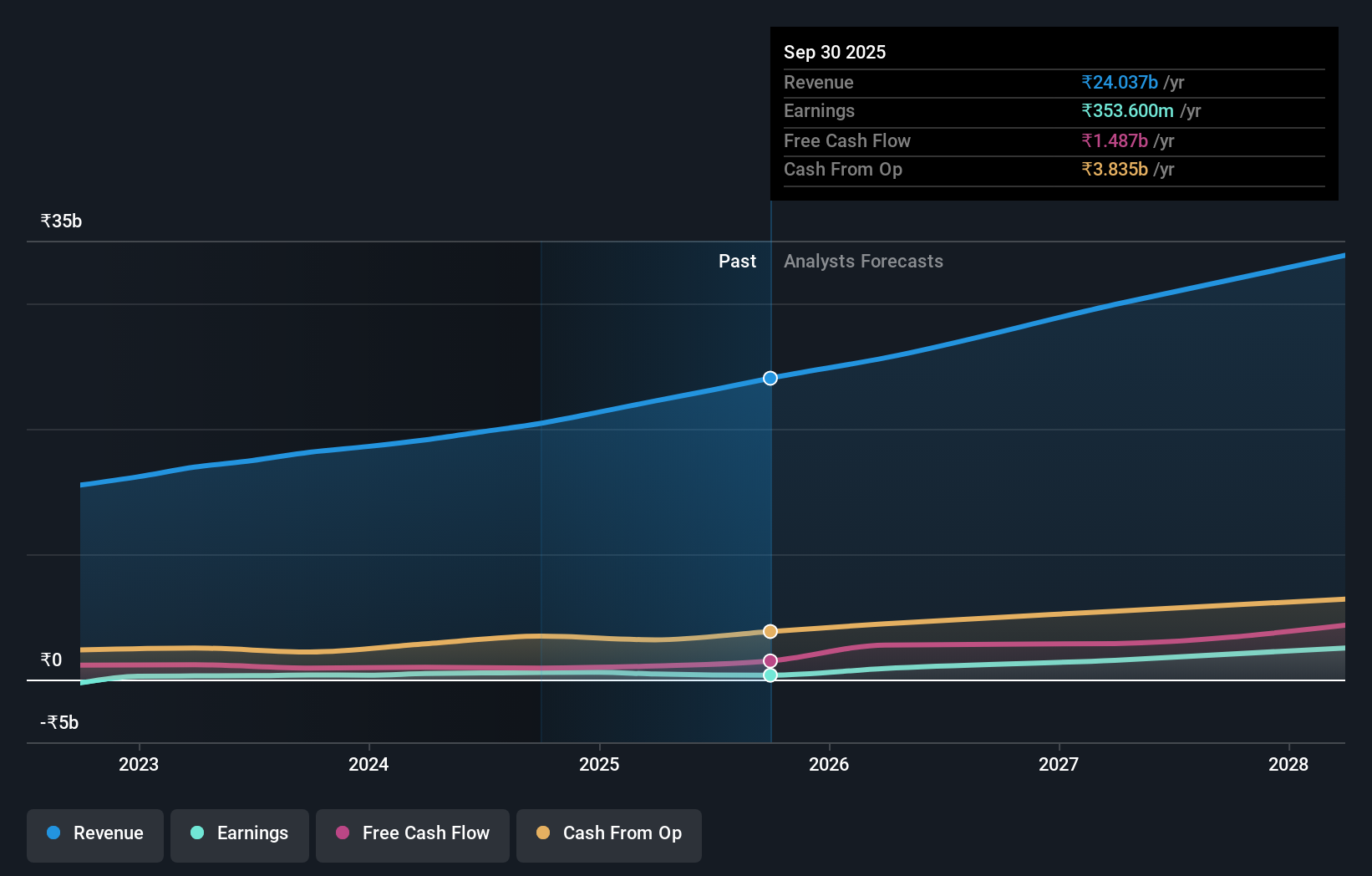

HealthCare Global Enterprises (NSEI:HCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HealthCare Global Enterprises Limited operates in the healthcare sector, primarily offering services related to cancer and fertility, with a market capitalization of approximately ₹50.33 billion.

Operations: The company generates ₹19.12 billion from setting up and managing hospitals and medical diagnostic services.

Insider Ownership: 13.8%

Revenue Growth Forecast: 12.1% p.a.

HealthCare Global Enterprises, a key player in India's healthcare sector, demonstrates robust growth with a 64% earnings increase over the past year. Despite lower-than-average forecasted Return on Equity at 11.7%, earnings are expected to rise by 38.2% annually, outpacing the Indian market prediction of 15.9%. Recent strategic moves include discussions on acquiring Vizag Hospital, highlighting expansion efforts despite challenges in covering interest payments with earnings and no significant insider trading activity noted recently.

- Unlock comprehensive insights into our analysis of HealthCare Global Enterprises stock in this growth report.

- Our valuation report unveils the possibility HealthCare Global Enterprises' shares may be trading at a premium.

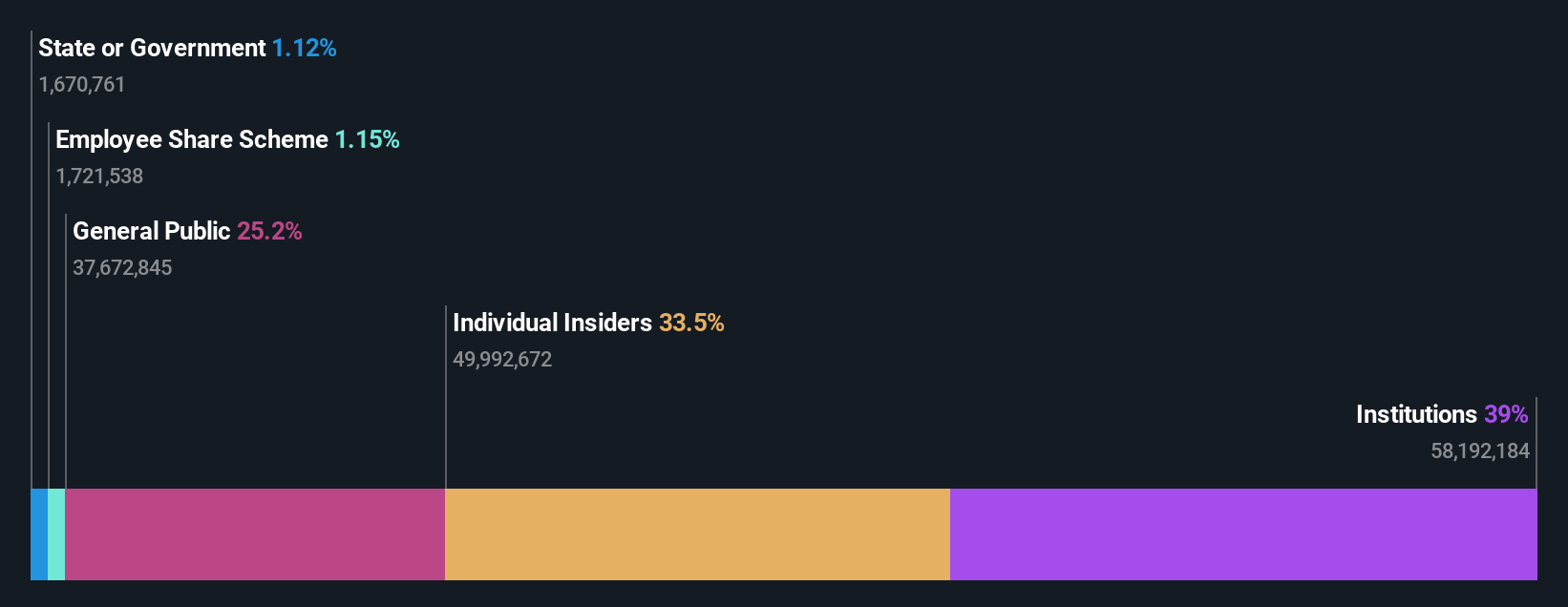

Persistent Systems (NSEI:PERSISTENT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Persistent Systems Limited is a global company based in India that offers software products, services, and technology solutions, with a market capitalization of approximately ₹70.73 billion.

Operations: Persistent Systems generates revenue from three primary segments: Healthcare & Life Sciences (₹20.88 billion), Software, Hi-Tech and Emerging Industries (₹45.95 billion), and Banking, Financial Services and Insurance (BFSI) at ₹31.39 billion.

Insider Ownership: 34.3%

Revenue Growth Forecast: 13.5% p.a.

Persistent Systems, an Indian technology company, shows moderate growth prospects with its revenue and earnings forecasted to grow at 13.5% and 18.1% annually, respectively—both rates surpassing the broader Indian market averages. While the company's Return on Equity is expected to be strong at 26.4%, it pays a modest dividend yield of 0.54%. Recent activities include executive changes and approval of dividends at its AGM, alongside launching innovative platforms like GenAI Hub to bolster enterprise AI applications.

- Dive into the specifics of Persistent Systems here with our thorough growth forecast report.

- Our expertly prepared valuation report Persistent Systems implies its share price may be too high.

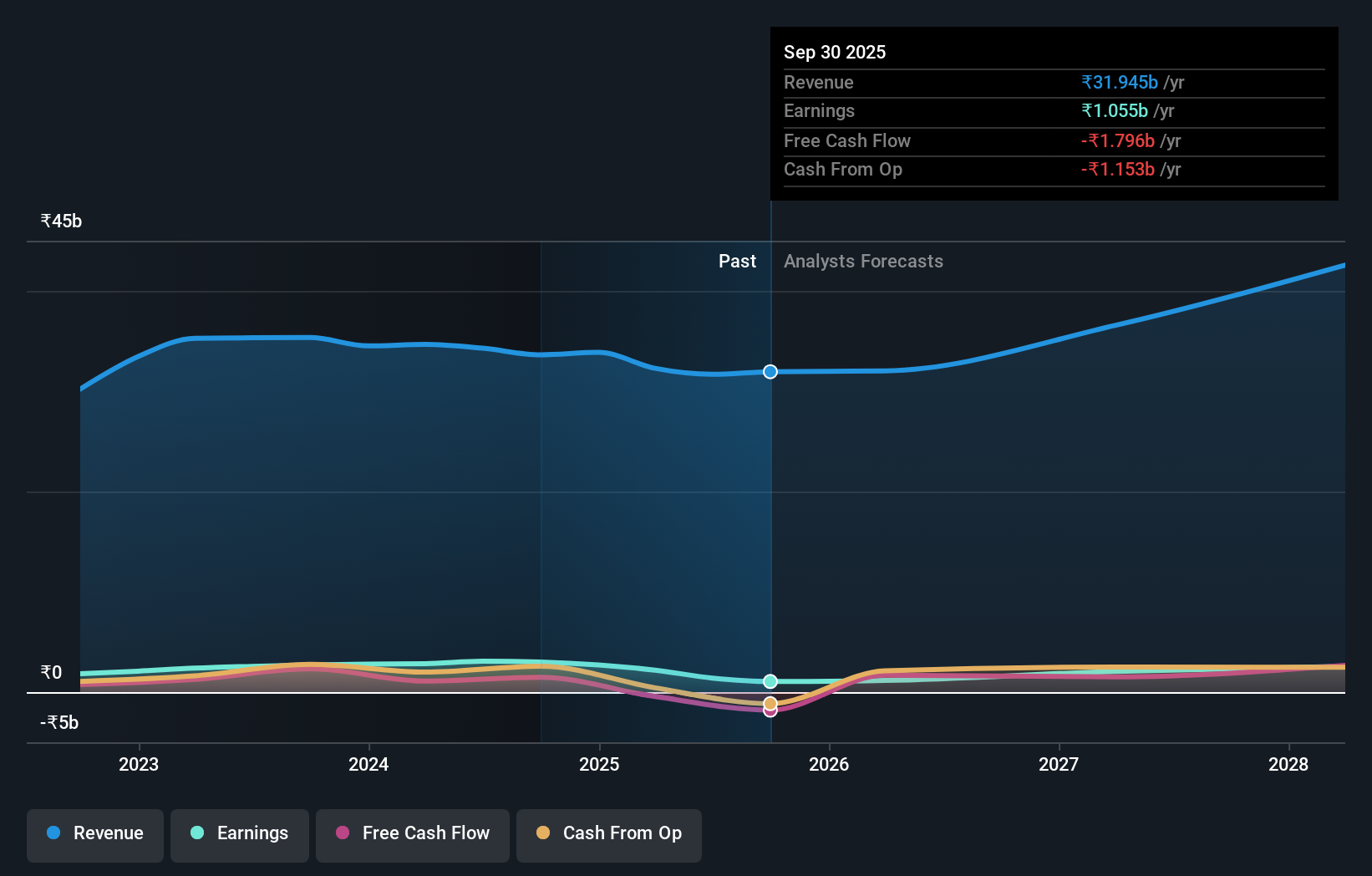

Praj Industries (NSEI:PRAJIND)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Praj Industries Limited specializes in bio-based technologies and engineering solutions globally, with a market capitalization of approximately ₹132.49 billion.

Operations: The company generates ₹34.66 billion in revenue from its Process and Project Engineering segment.

Insider Ownership: 29.1%

Revenue Growth Forecast: 16.5% p.a.

Praj Industries, a key player in India's growth sector with high insider ownership, has shown robust financial performance with a 34.6% annual earnings growth over the past five years and is projected to grow by 20.1% annually. Despite revenue growth forecasts being slightly slower at 16.5% yearly, it outpaces the Indian market average of 9.7%. However, its dividend coverage is weak due to low free cash flow. Recent board decisions include significant dividends and executive appointments, enhancing governance strength.

- Navigate through the intricacies of Praj Industries with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Praj Industries is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing Indian Companies With High Insider Ownership list of 83 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HealthCare Global Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:HCG

HealthCare Global Enterprises

Provides medical and healthcare services in India and internationally.

Reasonable growth potential with questionable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026