- India

- /

- Construction

- /

- NSEI:POWERMECH

Power Mech Projects Limited (NSE:POWERMECH) Soars 30% But It's A Story Of Risk Vs Reward

Power Mech Projects Limited (NSE:POWERMECH) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 6.1% isn't as impressive.

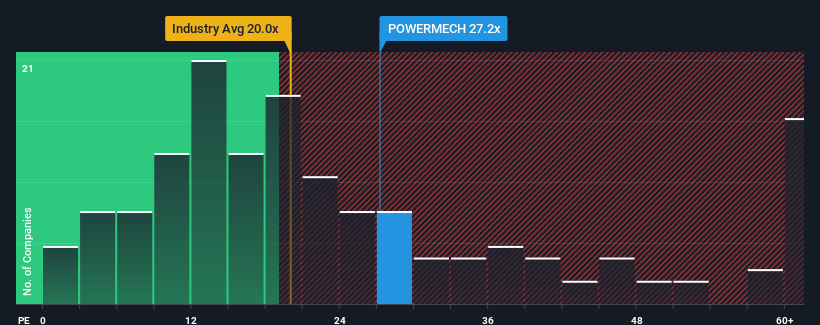

Although its price has surged higher, you could still be forgiven for feeling indifferent about Power Mech Projects' P/E ratio of 27.2x, since the median price-to-earnings (or "P/E") ratio in India is also close to 26x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate Power Mech Projects' and the market's earnings growth lately. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

See our latest analysis for Power Mech Projects

Is There Some Growth For Power Mech Projects?

The only time you'd be comfortable seeing a P/E like Power Mech Projects' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 18% gain to the company's bottom line. The latest three year period has also seen an excellent 115% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 52% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 25%, which is noticeably less attractive.

With this information, we find it interesting that Power Mech Projects is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Power Mech Projects' P/E?

Power Mech Projects' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Power Mech Projects' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Power Mech Projects with six simple checks.

If you're unsure about the strength of Power Mech Projects' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:POWERMECH

Power Mech Projects

Provides services in power and infrastructure sectors in India and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026