- India

- /

- Electrical

- /

- NSEI:POWERINDIA

Hitachi Energy India Limited's (NSE:POWERINDIA) Shareholders Might Be Looking For Exit

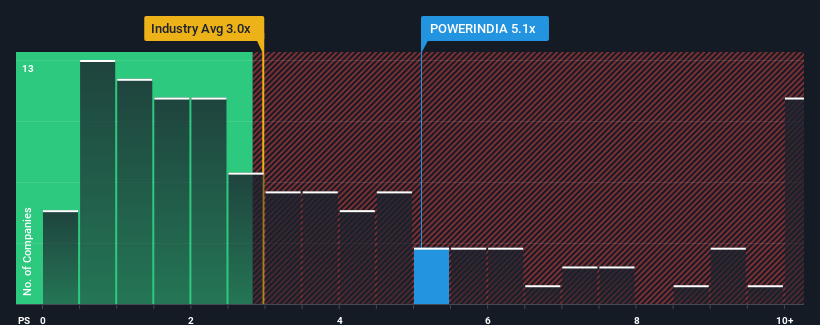

Hitachi Energy India Limited's (NSE:POWERINDIA) price-to-sales (or "P/S") ratio of 5.1x may look like a poor investment opportunity when you consider close to half the companies in the Electrical industry in India have P/S ratios below 3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Hitachi Energy India

What Does Hitachi Energy India's P/S Mean For Shareholders?

Recent times haven't been great for Hitachi Energy India as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hitachi Energy India will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Hitachi Energy India's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. The latest three year period has also seen an excellent 43% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 26% during the coming year according to the seven analysts following the company. That's shaping up to be materially lower than the 32% growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Hitachi Energy India's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that Hitachi Energy India currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Hitachi Energy India with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hitachi Energy India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:POWERINDIA

Hitachi Energy India

Offers products, projects, and services for electricity transmission and related activities in India and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives