Is Now The Time To Put Orient Bell (NSE:ORIENTBELL) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Orient Bell (NSE:ORIENTBELL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Orient Bell

Orient Bell's Improving Profits

Orient Bell has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Orient Bell's EPS skyrocketed from ₹16.81 to ₹22.54, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 34%.

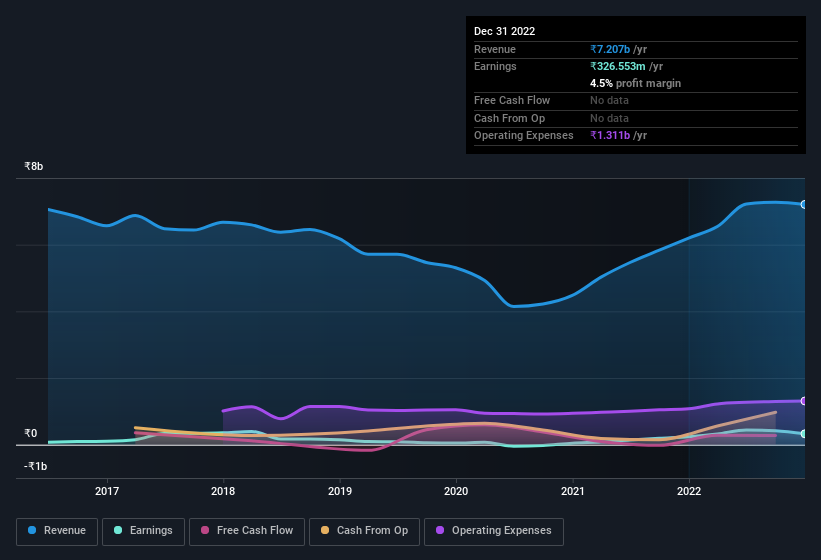

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Orient Bell maintained stable EBIT margins over the last year, all while growing revenue 16% to ₹7.2b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Orient Bell is no giant, with a market capitalisation of ₹9.1b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Orient Bell Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Orient Bell will be more than happy to see insiders committing themselves to the company, spending ₹33m on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. We also note that it was the Executive Chairman, Mahendra Daga, who made the biggest single acquisition, paying ₹20m for shares at about ₹500 each.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Orient Bell will reveal that insiders own a significant piece of the pie. Owning 43% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. To give you an idea, the value of insiders' holdings in the business are valued at ₹3.9b at the current share price. So there's plenty there to keep them focused!

Does Orient Bell Deserve A Spot On Your Watchlist?

You can't deny that Orient Bell has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. Now, you could try to make up your mind on Orient Bell by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Orient Bell, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ORIENTBELL

Orient Bell

Manufactures, trades in, and sells ceramic, wall, and floor tiles in India and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives