- India

- /

- Construction

- /

- NSEI:NILAINFRA

Nila Infrastructures (NSE:NILAINFRA) Has A Somewhat Strained Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Nila Infrastructures Limited (NSE:NILAINFRA) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Nila Infrastructures

What Is Nila Infrastructures's Net Debt?

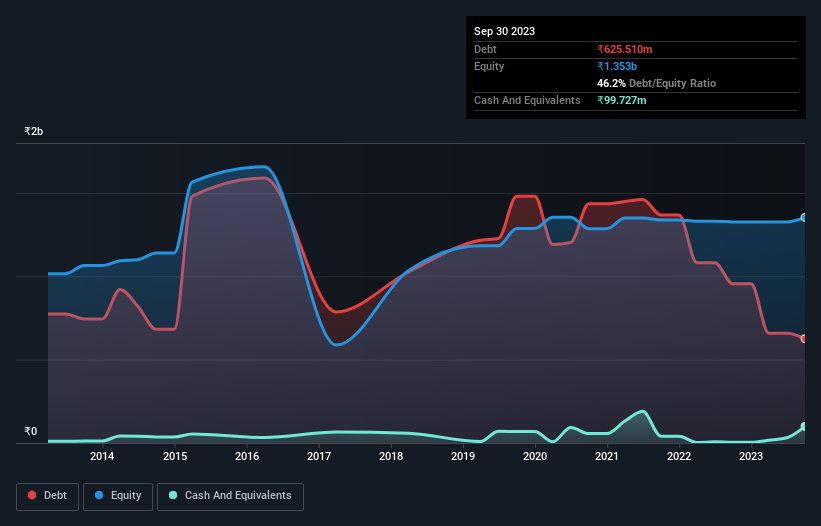

The image below, which you can click on for greater detail, shows that Nila Infrastructures had debt of ₹625.5m at the end of September 2023, a reduction from ₹955.2m over a year. On the flip side, it has ₹99.7m in cash leading to net debt of about ₹525.8m.

How Strong Is Nila Infrastructures' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Nila Infrastructures had liabilities of ₹7.06b due within 12 months and liabilities of ₹389.5m due beyond that. Offsetting this, it had ₹99.7m in cash and ₹361.4m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹6.99b.

The deficiency here weighs heavily on the ₹3.17b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Nila Infrastructures would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

As it happens Nila Infrastructures has a fairly concerning net debt to EBITDA ratio of 14.9 but very strong interest coverage of 1k. So either it has access to very cheap long term debt or that interest expense is going to grow! Shareholders should be aware that Nila Infrastructures's EBIT was down 42% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Nila Infrastructures will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Nila Infrastructures actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

To be frank both Nila Infrastructures's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Overall, it seems to us that Nila Infrastructures's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Nila Infrastructures is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Nila Infrastructures might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NILAINFRA

Nila Infrastructures

Nila Infrastructures Limited constructs and develops infrastructure and real estate projects in India.

Flawless balance sheet and fair value.

Market Insights

Community Narratives