- India

- /

- Aerospace & Defense

- /

- NSEI:MAZDOCK

Risks To Shareholder Returns Are Elevated At These Prices For Mazagon Dock Shipbuilders Limited (NSE:MAZDOCK)

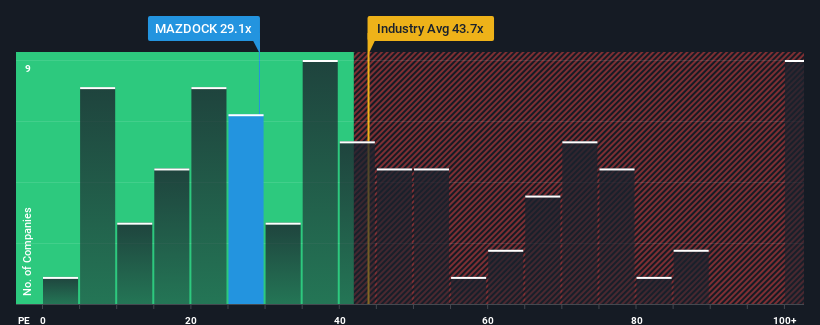

With a median price-to-earnings (or "P/E") ratio of close to 32x in India, you could be forgiven for feeling indifferent about Mazagon Dock Shipbuilders Limited's (NSE:MAZDOCK) P/E ratio of 29.1x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, Mazagon Dock Shipbuilders has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Mazagon Dock Shipbuilders

How Is Mazagon Dock Shipbuilders' Growth Trending?

The only time you'd be comfortable seeing a P/E like Mazagon Dock Shipbuilders' is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 68%. Pleasingly, EPS has also lifted 389% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 3.0% during the coming year according to the dual analysts following the company. With the market predicted to deliver 24% growth , the company is positioned for a weaker earnings result.

With this information, we find it interesting that Mazagon Dock Shipbuilders is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Mazagon Dock Shipbuilders' P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Mazagon Dock Shipbuilders currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Mazagon Dock Shipbuilders that you should be aware of.

If you're unsure about the strength of Mazagon Dock Shipbuilders' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAZDOCK

Mazagon Dock Shipbuilders

Engages in building and repairing of ships, submarines, vessels, and related engineering products in India and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives