- India

- /

- Aerospace & Defense

- /

- NSEI:MAZDOCK

Does Mazagon Dock Shipbuilders (NSE:MAZDOCK) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Mazagon Dock Shipbuilders (NSE:MAZDOCK). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Mazagon Dock Shipbuilders

Mazagon Dock Shipbuilders' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Mazagon Dock Shipbuilders has managed to grow EPS by 29% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

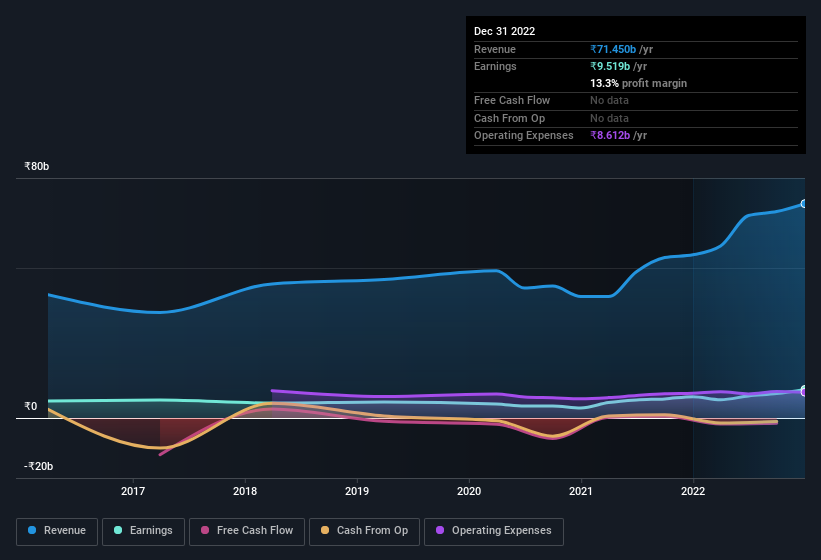

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Mazagon Dock Shipbuilders shareholders can take confidence from the fact that EBIT margins are up from 6.1% to 8.4%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Mazagon Dock Shipbuilders' future profits.

Are Mazagon Dock Shipbuilders Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Mazagon Dock Shipbuilders followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Indeed, they hold ₹1.6b worth of its stock. This considerable investment should help drive long-term value in the business. While their ownership only accounts for 1.1%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Mazagon Dock Shipbuilders with market caps between ₹83b and ₹265b is about ₹48m.

The CEO of Mazagon Dock Shipbuilders was paid just ₹4.7m in total compensation for the year ending March 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Mazagon Dock Shipbuilders To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Mazagon Dock Shipbuilders' strong EPS growth. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. This may only be a fast rundown, but the key takeaway is that Mazagon Dock Shipbuilders is worth keeping an eye on. Still, you should learn about the 2 warning signs we've spotted with Mazagon Dock Shipbuilders.

Although Mazagon Dock Shipbuilders certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAZDOCK

Mazagon Dock Shipbuilders

Engages in building and repairing of ships, submarines, vessels, and related engineering products in India and internationally.

Outstanding track record with flawless balance sheet.