Sorab Mody is the CEO of Mazda Limited (NSE:MAZDA), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Mazda

How Does Total Compensation For Sorab Mody Compare With Other Companies In The Industry?

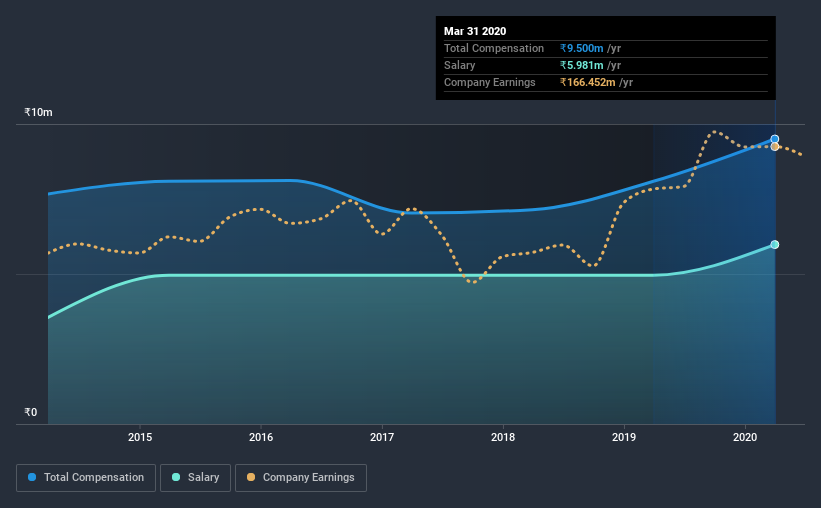

At the time of writing, our data shows that Mazda Limited has a market capitalization of ₹2.2b, and reported total annual CEO compensation of ₹9.5m for the year to March 2020. Notably, that's an increase of 17% over the year before. We note that the salary portion, which stands at ₹5.98m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹6.3m. Accordingly, our analysis reveals that Mazda Limited pays Sorab Mody north of the industry median. Furthermore, Sorab Mody directly owns ₹720m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹6.0m | ₹5.0m | 63% |

| Other | ₹3.5m | ₹3.1m | 37% |

| Total Compensation | ₹9.5m | ₹8.1m | 100% |

Speaking on an industry level, nearly 86% of total compensation represents salary, while the remainder of 14% is other remuneration. Mazda sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Mazda Limited's Growth Numbers

Mazda Limited's earnings per share (EPS) grew 15% per year over the last three years. In the last year, its revenue is up 13%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Mazda Limited Been A Good Investment?

Most shareholders would probably be pleased with Mazda Limited for providing a total return of 46% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

As we touched on above, Mazda Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But EPS growth and shareholder returns have been top-notch for the past three years. As a result of the excellent all-round performance of the company, we believe CEO compensation is fair. And given most shareholders are probably very happy with recent returns, they might even think that Sorab deserves a raise!

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 4 warning signs for Mazda that investors should look into moving forward.

Switching gears from Mazda, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Mazda, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:MAZDA

Mazda

Engages in the manufacturing of engineering goods in India and internationally.

Flawless balance sheet average dividend payer.