- India

- /

- Electrical

- /

- NSEI:MARINE

Undiscovered Gems In India For August 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat, but it is up 45% over the past year with earnings expected to grow by 17% per annum over the next few years. In this promising environment, identifying undiscovered gems that have strong fundamentals and growth potential can be particularly rewarding for investors.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Yuken India | 27.52% | 9.91% | -52.98% | ★★★★★★ |

| Vidhi Specialty Food Ingredients | 7.07% | 13.43% | 5.94% | ★★★★★★ |

| NGL Fine-Chem | 12.35% | 15.70% | 9.76% | ★★★★★★ |

| AGI Infra | 61.29% | 29.69% | 35.60% | ★★★★★★ |

| Piccadily Agro Industries | 50.57% | 13.78% | 39.75% | ★★★★★☆ |

| Nibe | 33.91% | 81.20% | 80.04% | ★★★★★☆ |

| Genesys International | 10.57% | 13.38% | 27.53% | ★★★★★☆ |

| Share India Securities | 24.23% | 37.66% | 48.98% | ★★★★☆☆ |

| Master Trust | 37.05% | 26.63% | 41.10% | ★★★★☆☆ |

| SG Mart | 16.73% | 99.32% | 94.08% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Gokul Agro Resources (NSEI:GOKULAGRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gokul Agro Resources Limited manufactures and trades in edible and non-edible oils, meals, and other agro products in India with a market cap of ₹30.58 billion.

Operations: Gokul Agro Resources generates revenue primarily from agro-based commodities, amounting to ₹156.80 billion. The company's financial performance is influenced by its gross profit margin, which has shown variability over recent periods.

Gokul Agro Resources, a small-cap player in the agro sector, has shown remarkable growth with earnings increasing by 28.4% over the past year, outpacing the food industry’s 14.1%. The company’s net debt to equity ratio stands at a satisfactory 20.1%, and its price-to-earnings ratio of 18.6x is attractive compared to the Indian market's 34.5x. Recent quarterly results reported sales of INR 42,902 million and net income of INR 528 million, indicating robust performance and high-quality earnings despite interest payments being only moderately covered by EBIT (2.3x).

- Unlock comprehensive insights into our analysis of Gokul Agro Resources stock in this health report.

Explore historical data to track Gokul Agro Resources' performance over time in our Past section.

Marine Electricals (India) (NSEI:MARINE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Marine Electricals (India) Limited manufactures and sells various marine and industrial electrical and electronic components in India and internationally, with a market cap of ₹33.94 billion.

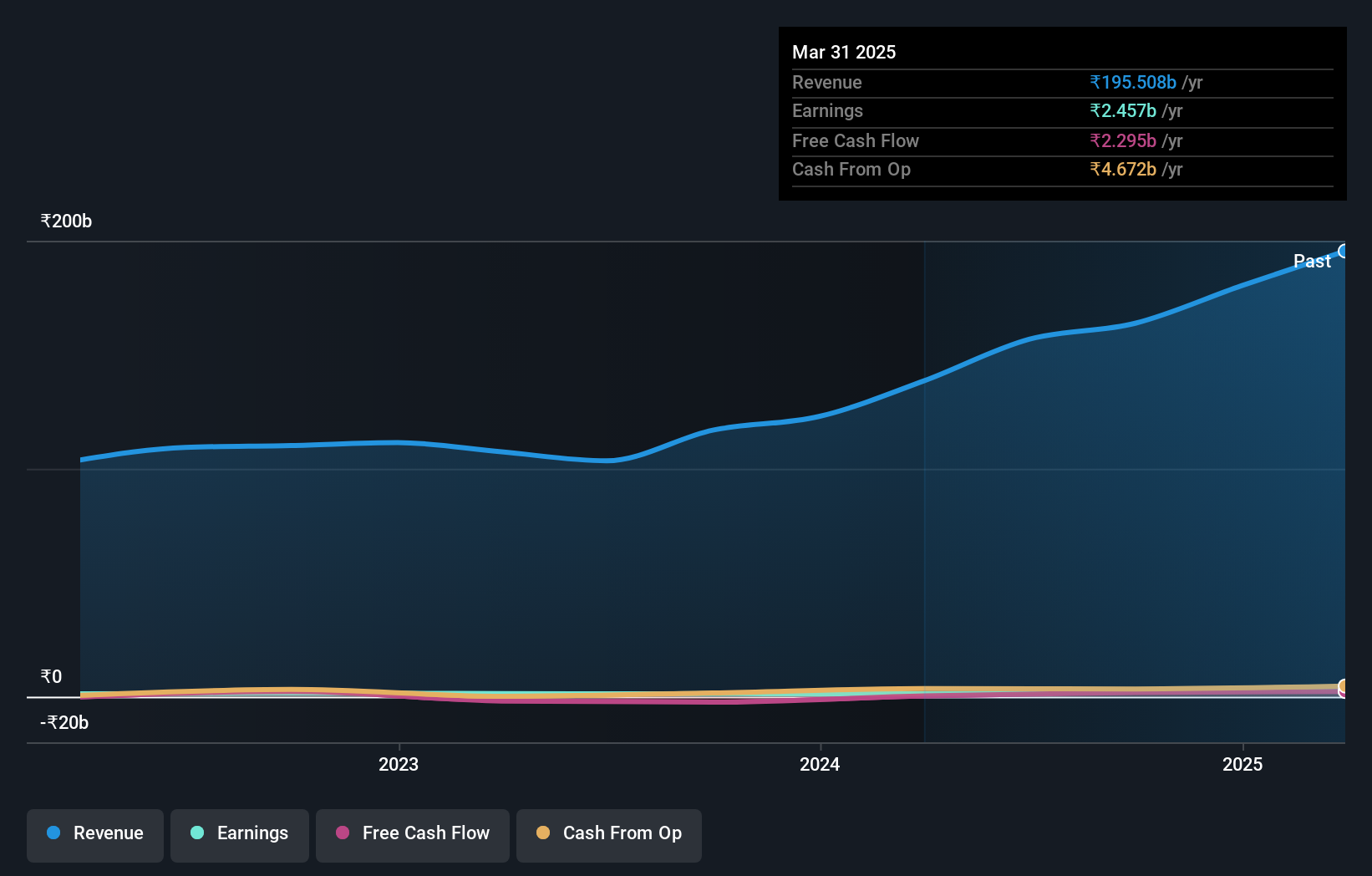

Operations: The company generates revenue primarily from its Marine segment (₹3.54 billion) and Industry segment (₹2.68 billion).

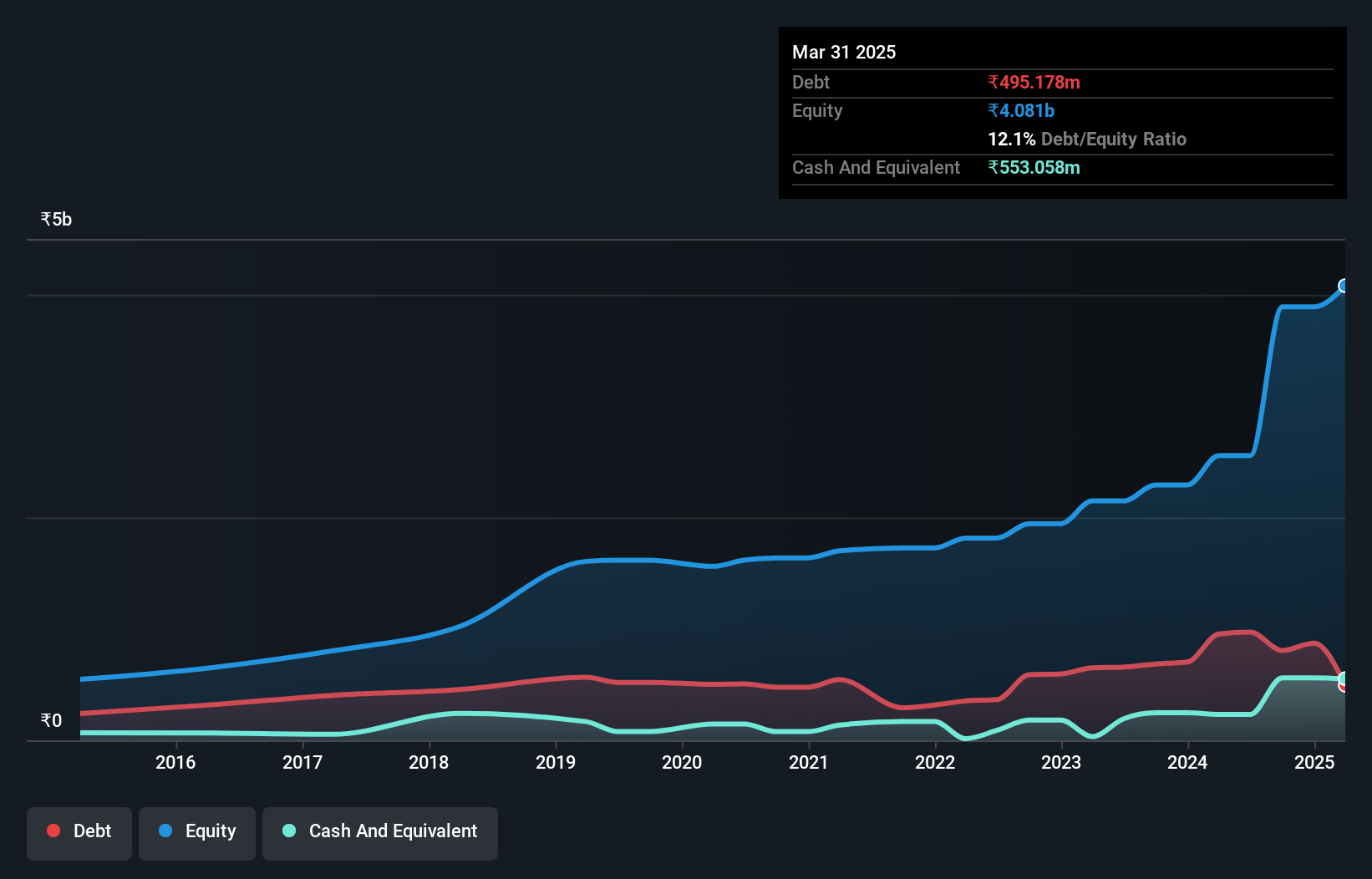

Marine Electricals (India) has shown impressive earnings growth of 52.4% over the past year, outpacing the Electrical industry's 29.1%. The company’s net debt to equity ratio stands at a satisfactory 28.3%, indicating manageable leverage. Despite an increase in its debt to equity ratio from 35.3% to 37.4% over five years, interest payments are well covered by EBIT at 3.3x coverage, reflecting strong operational performance and financial health amidst recent volatility in share price.

Ujaas Energy (NSEI:UEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ujaas Energy Limited focuses on the generation of solar power in India and has a market cap of ₹38.81 billion.

Operations: Ujaas Energy Limited's primary revenue streams include Solar Power Plant Operation (₹297.31 million) and Manufacturing and Sale of Solar Power Systems (₹172.52 million). The company also generates a smaller portion of revenue from EV-related activities (₹45.84 million).

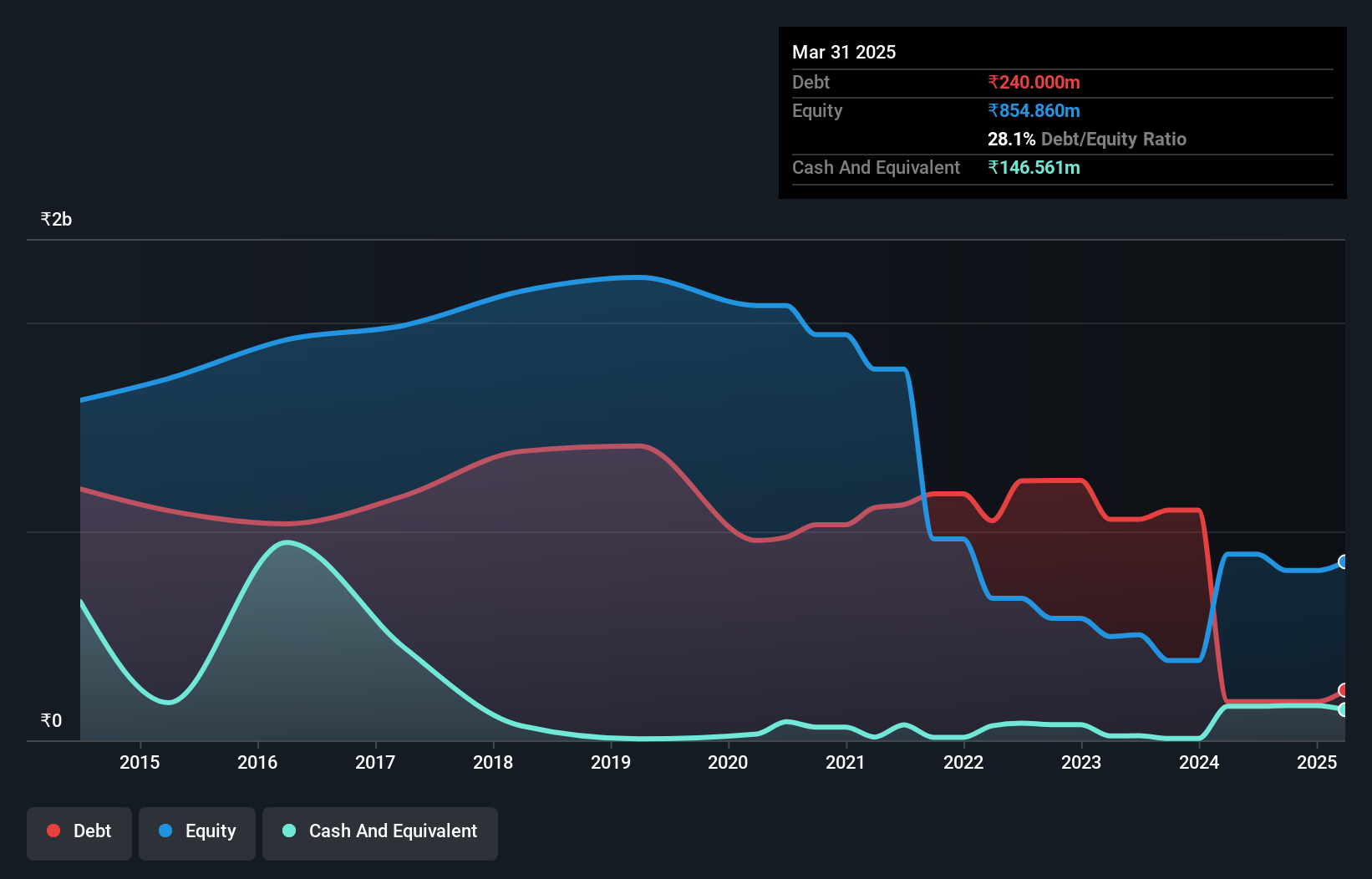

Ujaas Energy, a small cap player in the renewable energy sector, has shown notable financial improvements. The company reported a net income of ₹289.56 million for the year ending March 31, 2024, compared to a net loss of ₹180.57 million the previous year. Despite this turnaround, it recorded a large one-off loss of ₹93.8 million impacting its latest results. Additionally, UEL's debt to equity ratio improved significantly from 63.6% to 20.8% over five years and its interest coverage ratio stands at 2.2x EBIT.

- Click here to discover the nuances of Ujaas Energy with our detailed analytical health report.

Understand Ujaas Energy's track record by examining our Past report.

Where To Now?

- Embark on your investment journey to our 460 Indian Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MARINE

Marine Electricals (India)

Manufactures and sells various marine and industrial electrical and electronic components in India and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives