Should You Be Adding Lokesh Machines (NSE:LOKESHMACH) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Lokesh Machines (NSE:LOKESHMACH). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Lokesh Machines

How Fast Is Lokesh Machines Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Lokesh Machines has managed to grow EPS by 35% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

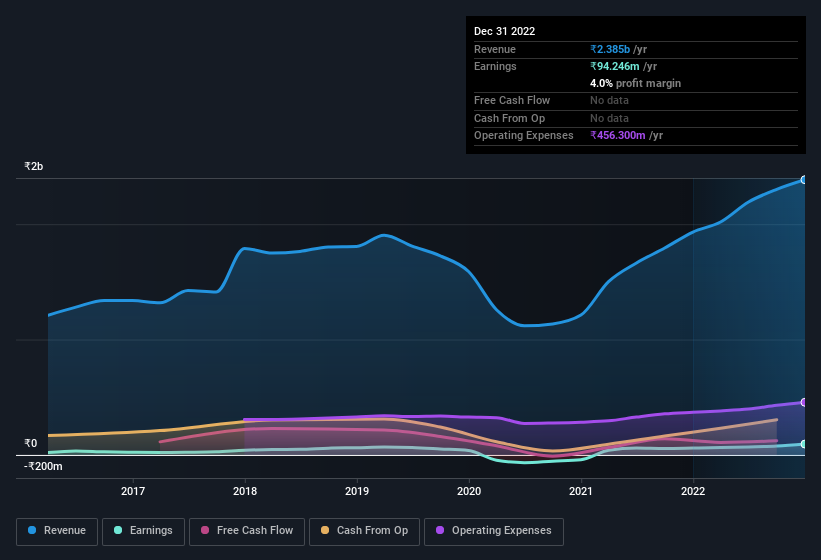

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Lokesh Machines achieved similar EBIT margins to last year, revenue grew by a solid 23% to ₹2.4b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Lokesh Machines is no giant, with a market capitalisation of ₹1.9b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Lokesh Machines Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Lokesh Machines shares, in the last year. So it's definitely nice that MD & Executive Director Lokeswara Mullapudi bought ₹3.5m worth of shares at an average price of around ₹76.84. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Lokesh Machines will reveal that insiders own a significant piece of the pie. Indeed, with a collective holding of 57%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Although, with Lokesh Machines being valued at ₹1.9b, this is a small company we're talking about. That means insiders only have ₹1.1b worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Should You Add Lokesh Machines To Your Watchlist?

You can't deny that Lokesh Machines has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. Astute investors will want to keep this stock on watch. You should always think about risks though. Case in point, we've spotted 2 warning signs for Lokesh Machines you should be aware of, and 1 of them is a bit concerning.

Keen growth investors love to see insider buying. Thankfully, Lokesh Machines isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LOKESHMACH

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.