- India

- /

- Capital Markets

- /

- NSEI:PRUDENT

Exploring Undiscovered Indian Stocks July 2024

Reviewed by Simply Wall St

The Indian stock market has shown remarkable growth, climbing 2.3% in the past week and an impressive 45% over the last year, with earnings projected to grow by 16% annually. In this vibrant environment, identifying stocks that have not yet caught the attention of the majority can offer unique opportunities for investors looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Voith Paper Fabrics India | NA | 10.79% | 9.57% | ★★★★★★ |

| BLS E-Services | NA | 43.93% | 59.81% | ★★★★★★ |

| Bengal & Assam | 4.48% | 3.82% | 47.41% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 20.60% | 62.92% | ★★★★★☆ |

| Avantel | 10.67% | 34.84% | 36.61% | ★★★★★☆ |

| Spright Agro | 0.58% | 83.13% | 86.22% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Kalyani Investment | NA | 18.19% | 3.65% | ★★★★★☆ |

| Apollo Micro Systems | 38.17% | 7.94% | 2.46% | ★★★★☆☆ |

| Rir Power Electronics | 53.98% | 13.52% | 31.41% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Jai Balaji Industries (NSEI:JAIBALAJI)

Simply Wall St Value Rating: ★★★★★★

Overview: Jai Balaji Industries Limited is an Indian company engaged in the manufacturing and marketing of iron and steel products, with a market capitalization of approximately ₹159.91 billion.

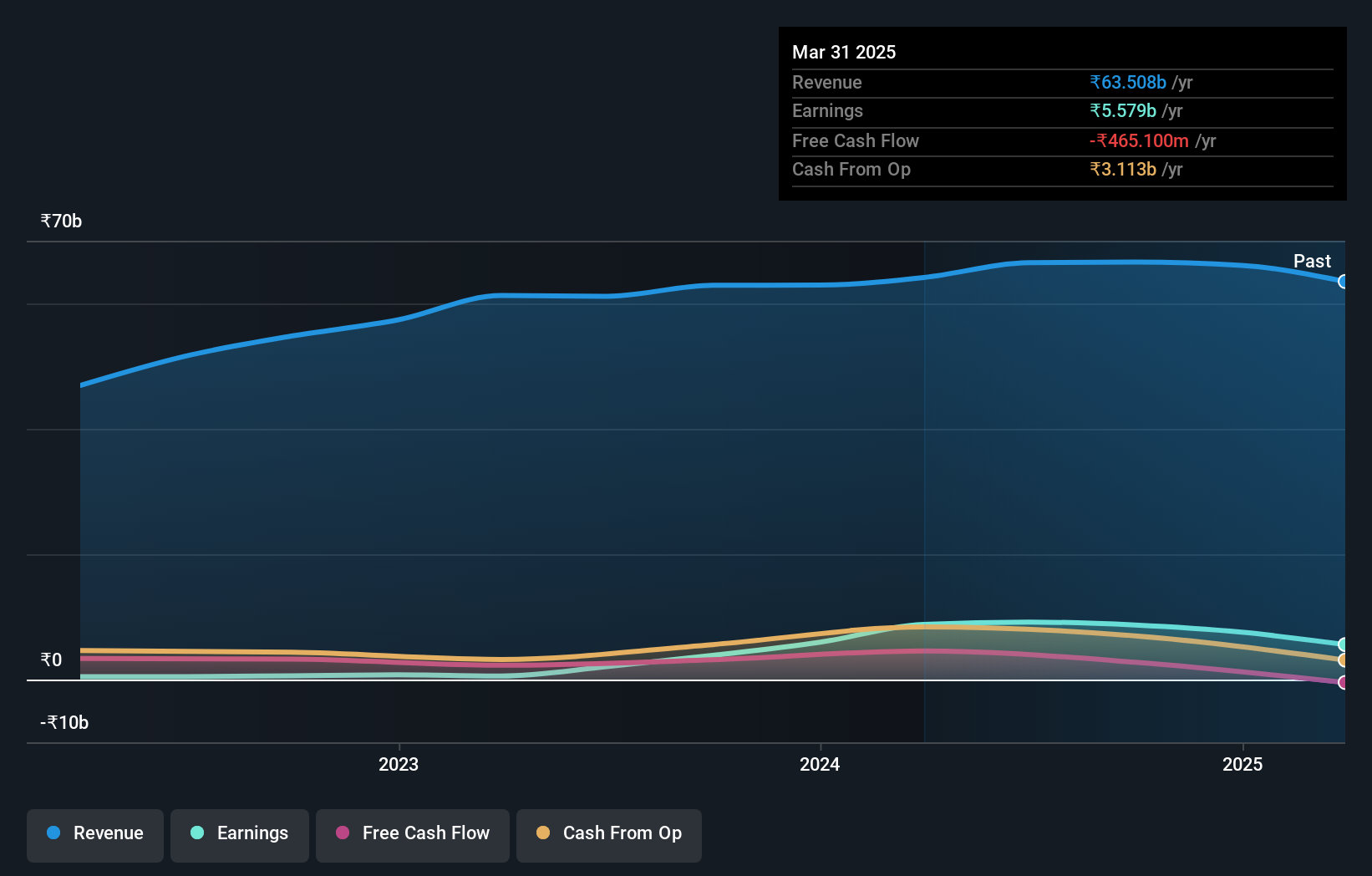

Operations: The company operates in the iron and steel sector, generating a revenue of ₹64.14 billion as of the latest reporting period. It has shown a significant improvement in its net income margin, reaching 13.71% from previous negative margins, reflecting enhanced operational efficiency and profitability over time.

Jai Balaji Industries, a notable player in the Metals and Mining sector, has shown remarkable financial performance with a year-over-year earnings growth of 1420.9%, significantly outpacing the industry average of 18.8%. The company's Price-To-Earnings ratio stands at 18.2x, appealingly below the Indian market average of 34.4x. With a satisfactory net debt to equity ratio of 25.3% and interest payments well covered by EBIT (11.3x coverage), Jai Balaji demonstrates strong fiscal health and operational efficiency, making it an intriguing prospect for those looking into lesser-explored markets.

- Navigate through the intricacies of Jai Balaji Industries with our comprehensive health report here.

Assess Jai Balaji Industries' past performance with our detailed historical performance reports.

Lloyds Engineering Works (NSEI:LLOYDSENGG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lloyds Engineering Works Limited specializes in engineering products and services across India, with a market capitalization of ₹105.02 billion.

Operations: Lloyds Engineering Works primarily generates revenue from engineering products and services, with its latest reported revenue reaching ₹6.24 billion. The company has demonstrated a significant growth in net income, reporting ₹798.38 million in the most recent quarter, reflecting an upward trend in profitability and operational efficiency.

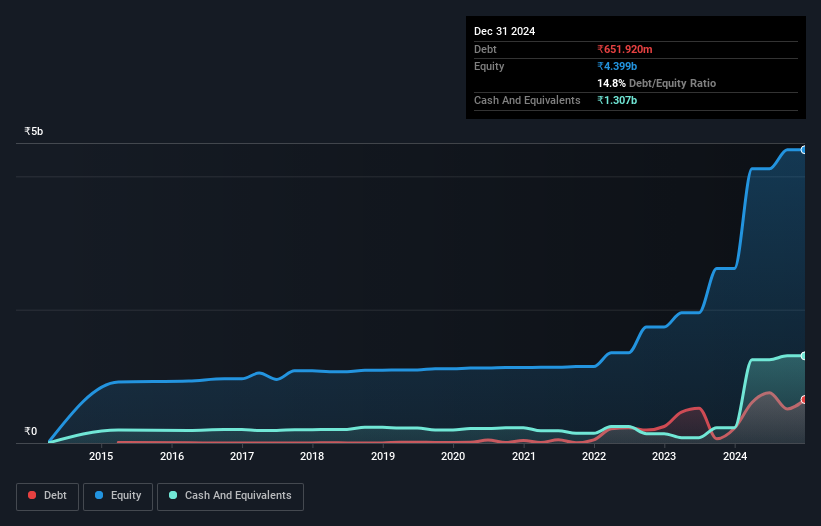

Lloyds Engineering Works, an emerging player in the machinery industry, has demonstrated robust growth with earnings soaring by 116.8% over the past year, outpacing its industry's growth of 28.6%. Despite a significant increase in its debt-to-equity ratio from 1.1% to 14.8% over five years, the company maintains a higher cash position than total debt. Recent strategic moves include plans to raise up to INR 12,000 million through various equity issuances and an impressive dividend proposal of INR 0.20 per share for FY2024, reflecting confidence in sustained profitability and shareholder value enhancement.

Prudent Advisory Services (NSEI:PRUDENT)

Simply Wall St Value Rating: ★★★★★★

Overview: Prudent Corporate Advisory Services Limited offers advisory and distribution services for a range of mutual funds, catering to individuals, corporates, high net worth individuals (HNIs), and ultra HNIs both in India and globally, with a market capitalization of ₹98.84 billion.

Operations: Prudent Advisory Services generates its revenue primarily through the distribution and sale of financial products, achieving a revenue of ₹8.23 billion as of the latest reporting period. The company has seen a notable increase in gross profit, with margins consistently above 45%, reflecting efficient cost management relative to its sales.

Prudent Corporate Advisory Services, a notable player in the Indian market, has demonstrated robust financial health with no debt and a debt-to-equity shift from 27.5% five years ago to zero today. The company's earnings have surged by 28.8% annually over the past five years and are projected to grow by 22.77% per year moving forward. Recently, Prudent announced a dividend increase and reported significant year-over-year revenue growth from INR 6,188 million to INR 8,247 million, underscoring its potential as an emerging gem in the capital markets sector.

Turning Ideas Into Actions

- Explore the 457 names from our Indian Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PRUDENT

Prudent Advisory Services

Provides various solutions for financial products distribution to individuals, corporates, high net worth individuals, and ultra-high net worth individuals in India and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026