November 2024's Top Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

In a week marked by mixed economic signals and cautious market sentiment, small-cap stocks have shown resilience, outperforming their larger counterparts amid a flurry of earnings reports and macroeconomic updates. As global markets navigate these uncertain waters, investors are increasingly turning their attention to small-cap opportunities that may offer value in the current environment. Identifying promising small-cap stocks involves looking at factors such as strong fundamentals, potential for growth, and insider buying activity—elements that can indicate confidence from those closest to the company.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.8x | 0.9x | 20.68% | ★★★★★★ |

| Calfrac Well Services | 2.5x | 0.2x | 18.41% | ★★★★★☆ |

| Franklin Financial Services | 10.3x | 2.0x | 34.65% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -41.14% | ★★★★☆☆ |

| L.G. Balakrishnan & Bros | 15.1x | 1.7x | -49.15% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Safari Investments RSA | 5.6x | 3.2x | 5.35% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -39.46% | ★★★☆☆☆ |

| Bajel Projects | 263.6x | 2.1x | 24.34% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -27.47% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Aurum PropTech (NSEI:AURUM)

Simply Wall St Value Rating: ★★★☆☆☆

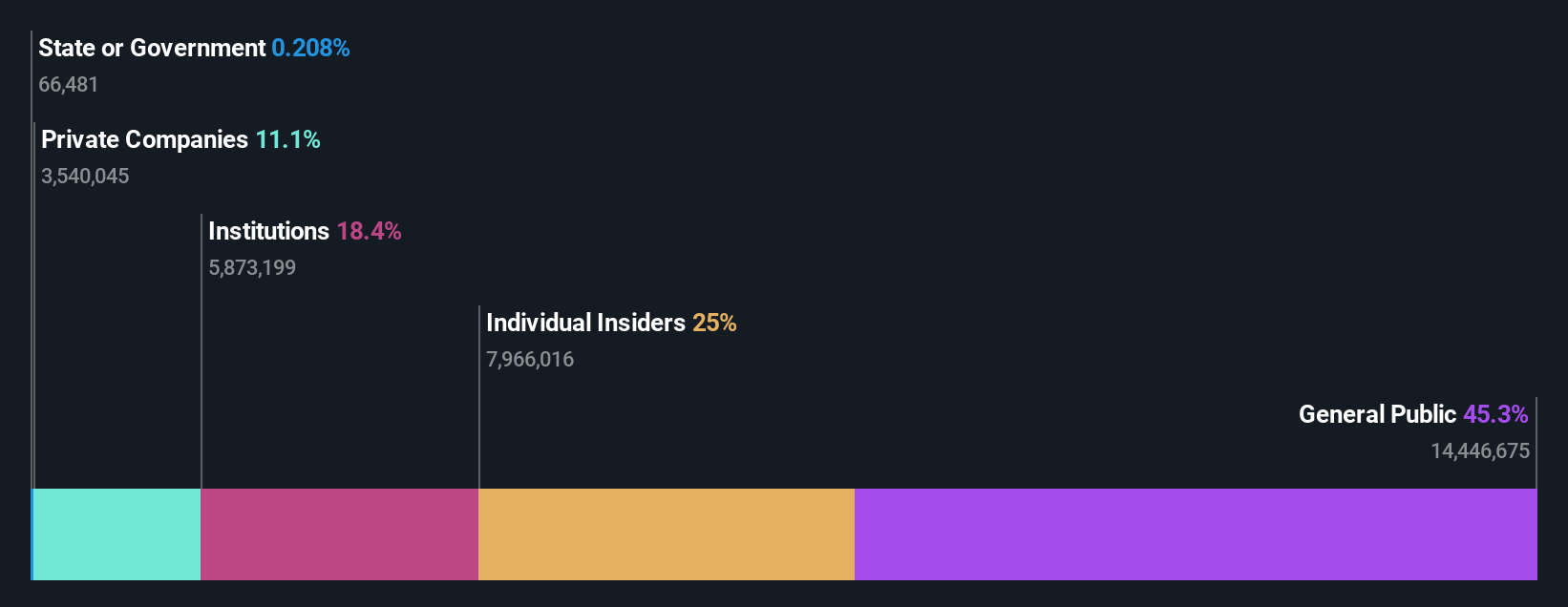

Overview: Aurum PropTech focuses on leveraging technology to enhance the real estate sector, with a market capitalization of ₹4.89 billion.

Operations: Aurum PropTech generates revenue primarily through its operations, with a recent focus on improving gross profit margins, which reached 62.24% in September 2024. The company's cost of goods sold (COGS) and operating expenses are significant components of its financial structure, impacting net income figures, which have been negative in recent periods. Notably, the gross profit margin has shown an upward trend from 50.42% in March 2023 to over 62% by September 2024.

PE: -56.5x

Aurum PropTech, a smaller company in the tech space, recently reported improved financials with revenue of INR 676.1 million for Q2 2024, up from INR 575.3 million the previous year. Despite a net loss of INR 95.5 million, this marks a significant reduction from last year's INR 201 million loss. Insider confidence is evident as they focus on strategic acquisitions post-NestAway integration. The appointment of new auditors suggests an emphasis on transparency and governance moving forward.

- Click here and access our complete valuation analysis report to understand the dynamics of Aurum PropTech.

Understand Aurum PropTech's track record by examining our Past report.

L.G. Balakrishnan & Bros (NSEI:LGBBROSLTD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: L.G. Balakrishnan & Bros is a company engaged in the manufacturing of transmission products and metal forming components, with a market capitalization of ₹32.91 billion.

Operations: The company's primary revenue streams are from the Transmission segment, generating ₹19.14 billion, and Metal Forming, contributing ₹5.26 billion. Over recent periods, the gross profit margin has shown notable fluctuations, reaching as high as 55.53% in June 2024 and standing at 53.64% in September 2024.

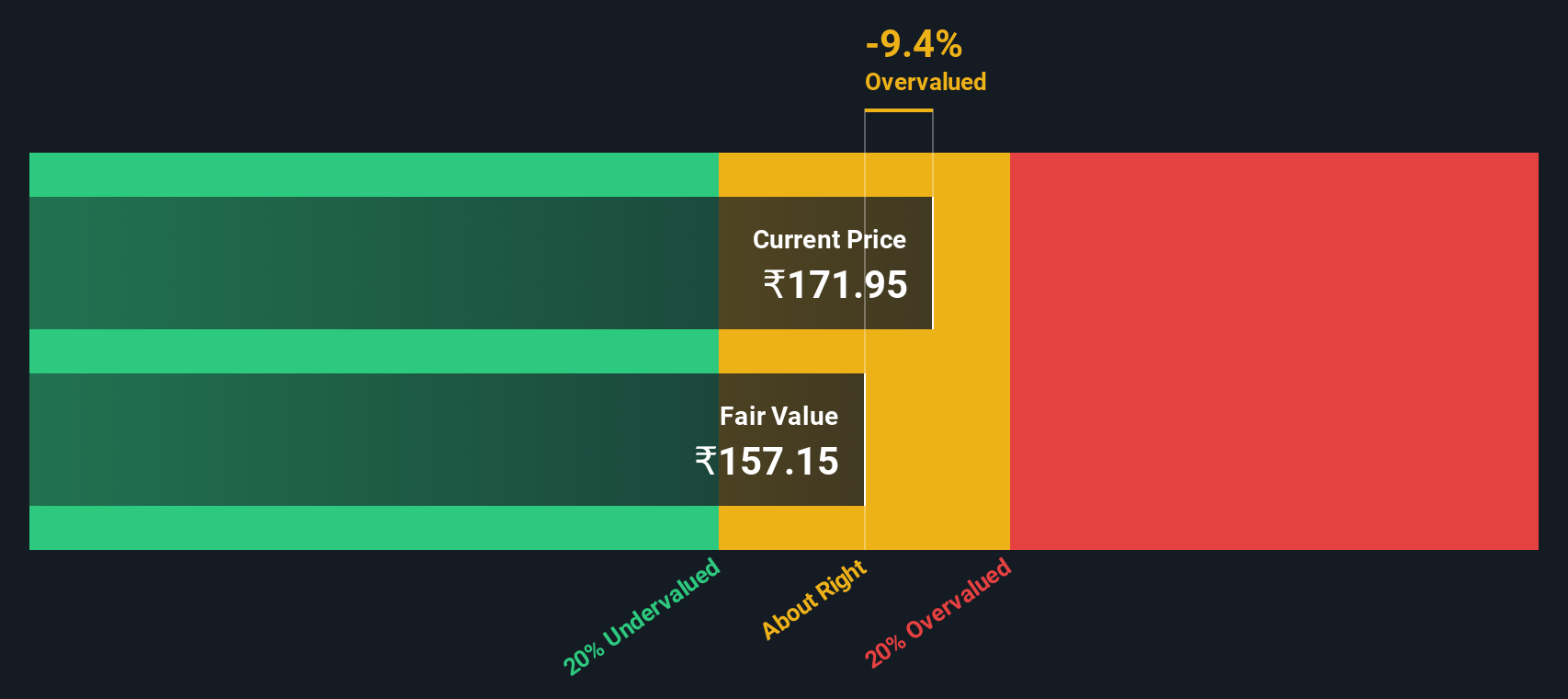

PE: 15.1x

L.G. Balakrishnan & Bros, a company with a market cap that places it among smaller firms, recently reported increased sales of ₹6.6 billion for Q2 2024, up from ₹6 billion the previous year. Revenue also rose to ₹6.7 billion from ₹6.1 billion, while net income saw a modest increase to ₹775 million compared to last year's figures. Insider confidence is evident as they purchased shares in recent months, indicating potential optimism about future growth despite reliance on external borrowing for funding.

- Click to explore a detailed breakdown of our findings in L.G. Balakrishnan & Bros' valuation report.

Gain insights into L.G. Balakrishnan & Bros' past trends and performance with our Past report.

Paradeep Phosphates (NSEI:PARADEEP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Paradeep Phosphates is a company engaged in the production and trading of fertilizers and other related materials, with a market capitalization of ₹37.74 billion.

Operations: The company's revenue primarily comes from fertilizers and trading materials, with a notable gross profit margin of 26.35% as of September 2024. Over recent periods, the cost of goods sold has been a significant component affecting profitability, while operating expenses have also played a substantial role in the financial structure.

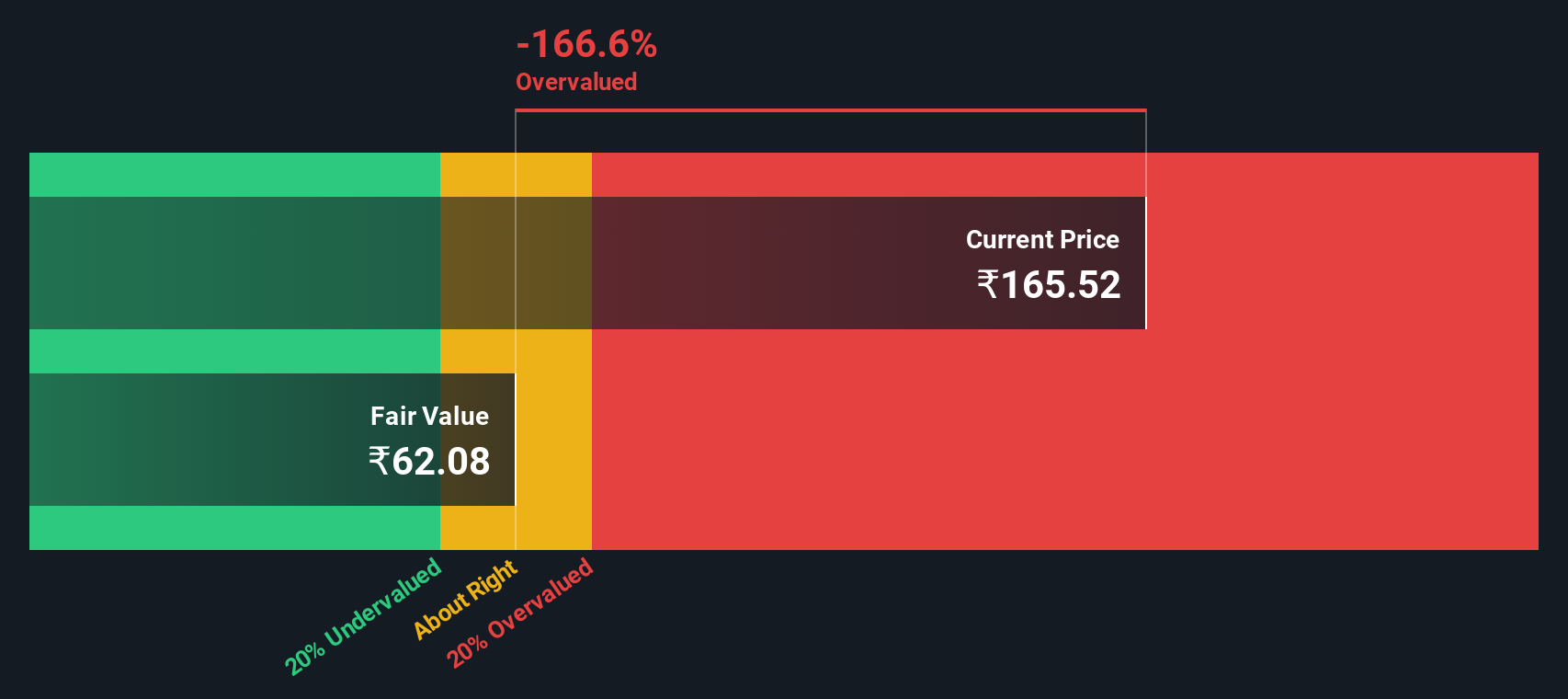

PE: 23.1x

Paradeep Phosphates, a company in the fertilizer industry, has shown significant growth potential with earnings for Q2 2024 reaching INR 2,276.3 million, a notable increase from INR 894.3 million the previous year. Insider confidence is evident as they have increased their shareholdings recently. The company's strategic brownfield expansion aims to enhance operational efficiency and profitability by boosting phosphoric acid capacity to 0.7 MMTPA. However, regulatory challenges persist with recent environmental compensation and tax reassessment issues impacting operations but not derailing growth prospects entirely.

Seize The Opportunity

- Click here to access our complete index of 186 Undervalued Small Caps With Insider Buying.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PARADEEP

Paradeep Phosphates

Manufactures, trades, distributes, and sells urea and complex fertilizers in India.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives