L.G. Balakrishnan & Bros Limited (NSE:LGBBROSLTD) Surges 26% Yet Its Low P/E Is No Reason For Excitement

L.G. Balakrishnan & Bros Limited (NSE:LGBBROSLTD) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

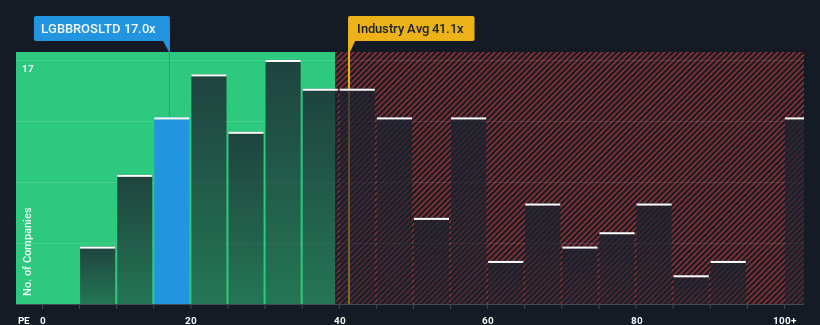

Even after such a large jump in price, L.G. Balakrishnan & Bros' price-to-earnings (or "P/E") ratio of 17x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 34x and even P/E's above 66x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's inferior to most other companies of late, L.G. Balakrishnan & Bros has been relatively sluggish. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

See our latest analysis for L.G. Balakrishnan & Bros

Is There Any Growth For L.G. Balakrishnan & Bros?

L.G. Balakrishnan & Bros' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.7% last year. The latest three year period has also seen an excellent 103% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 9.5% over the next year. Meanwhile, the rest of the market is forecast to expand by 25%, which is noticeably more attractive.

In light of this, it's understandable that L.G. Balakrishnan & Bros' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From L.G. Balakrishnan & Bros' P/E?

Despite L.G. Balakrishnan & Bros' shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that L.G. Balakrishnan & Bros maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for L.G. Balakrishnan & Bros that we have uncovered.

If these risks are making you reconsider your opinion on L.G. Balakrishnan & Bros, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:LGBBROSLTD

L.G. Balakrishnan & Bros

Manufactures and sells chains, sprockets, and metal formed parts for automotive and industrial applications in India and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives