Latteys Industries Limited (NSE:LATTEYS) Stocks Pounded By 28% But Not Lagging Market On Growth Or Pricing

To the annoyance of some shareholders, Latteys Industries Limited (NSE:LATTEYS) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 27% in that time.

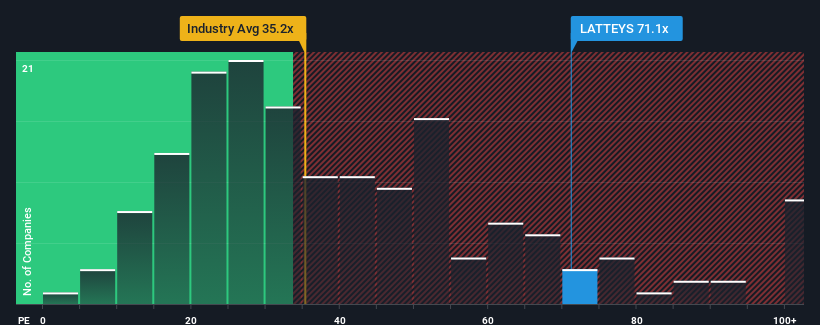

In spite of the heavy fall in price, given close to half the companies in India have price-to-earnings ratios (or "P/E's") below 32x, you may still consider Latteys Industries as a stock to avoid entirely with its 71.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For example, consider that Latteys Industries' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Latteys Industries

How Is Latteys Industries' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Latteys Industries' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's bottom line. Even so, admirably EPS has lifted 163% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Latteys Industries is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

Latteys Industries' shares may have retreated, but its P/E is still flying high. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Latteys Industries revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Latteys Industries (2 are a bit unpleasant) you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LATTEYS

Latteys Industries

Manufactures and sells pumps for domestic/residential, agriculture, industrial, and horticultural sectors in India.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives