Kirloskar Oil Engines (NSE:KIRLOSENG) jumps 10% this week, though earnings growth is still tracking behind five-year shareholder returns

Kirloskar Oil Engines Limited (NSE:KIRLOSENG) shareholders might understandably be very concerned that the share price has dropped 43% in the last quarter. But that doesn't undermine the fantastic longer term performance (measured over five years). In fact, during that period, the share price climbed 498%. Impressive! Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Kirloskar Oil Engines

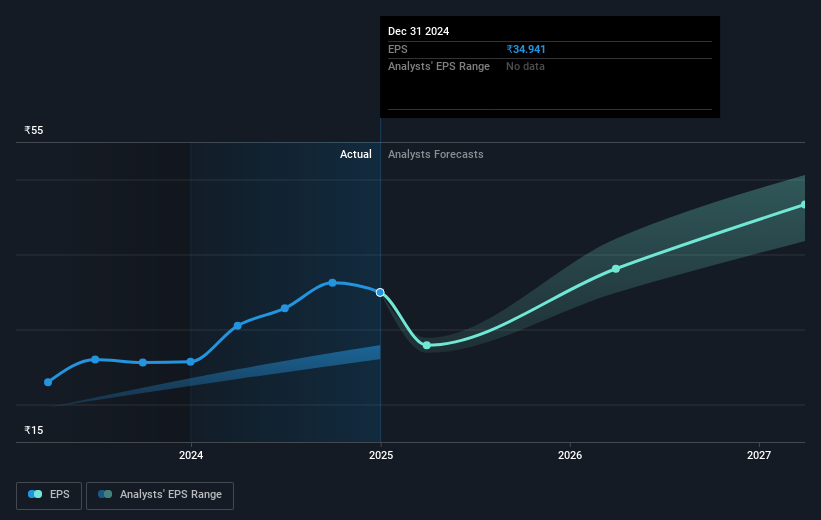

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Kirloskar Oil Engines managed to grow its earnings per share at 18% a year. This EPS growth is lower than the 43% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Kirloskar Oil Engines has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Kirloskar Oil Engines' balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Kirloskar Oil Engines the TSR over the last 5 years was 567%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 2.1% in the twelve months, Kirloskar Oil Engines shareholders did even worse, losing 23% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 46% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Kirloskar Oil Engines (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

Of course Kirloskar Oil Engines may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kirloskar Oil Engines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KIRLOSENG

Kirloskar Oil Engines

Manufactures and distributes diesel engines, agricultural pump sets, electric pump sets, power tillers, generating sets, and spares in India and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives