- India

- /

- Electrical

- /

- NSEI:KECL

Recent 13% pullback isn't enough to hurt long-term Kirloskar Electric (NSE:KECL) shareholders, they're still up 652% over 3 years

Kirloskar Electric Company Limited (NSE:KECL) shareholders have seen the share price descend 28% over the month. But that doesn't change the fact that the returns over the last three years have been spectacular. In fact, the share price has taken off in that time, up 652%. Arguably, the recent fall is to be expected after such a strong rise. The thing to consider is whether there is still too much elation around the company's prospects. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since the long term performance has been good but there's been a recent pullback of 13%, let's check if the fundamentals match the share price.

Check out our latest analysis for Kirloskar Electric

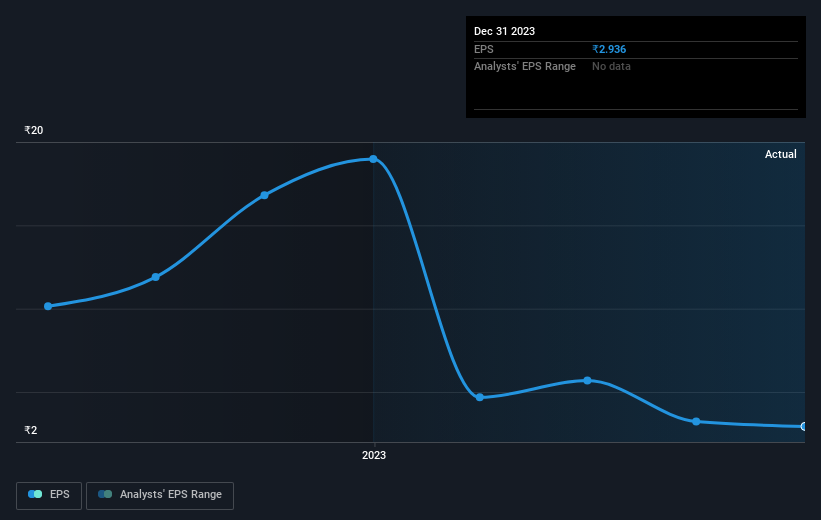

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Kirloskar Electric moved from a loss to profitability. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Kirloskar Electric's key metrics by checking this interactive graph of Kirloskar Electric's earnings, revenue and cash flow.

A Different Perspective

Kirloskar Electric's TSR for the year was broadly in line with the market average, at 47%. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 41%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Kirloskar Electric has 5 warning signs (and 2 which make us uncomfortable) we think you should know about.

But note: Kirloskar Electric may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kirloskar Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KECL

Kirloskar Electric

Engages in the manufacturing and sale of various electrical equipment in India and internationally.

Slight with mediocre balance sheet.