3 Indian Stocks With High Insider Ownership Expecting Up To 32% Revenue Growth

Reviewed by Simply Wall St

The Utilities sector gained 3.5% while the market remained flat over the last week, and overall, the market is up 44% over the past year with earnings forecast to grow by 17% annually. In such a robust environment, stocks with high insider ownership and strong growth prospects can be particularly appealing to investors looking for potential opportunities.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 35.8% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

Let's explore several standout options from the results in the screener.

Intellect Design Arena (NSEI:INTELLECT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intellect Design Arena Limited develops software and provides related services for banking, insurance, and financial sectors globally, with a market cap of ₹137.87 billion.

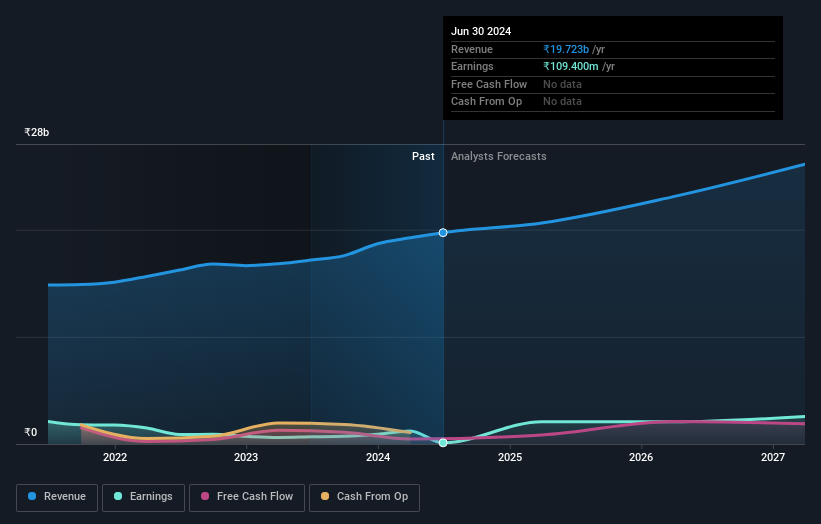

Operations: The company's revenue primarily comes from software product licenses and related services, generating ₹24.73 billion.

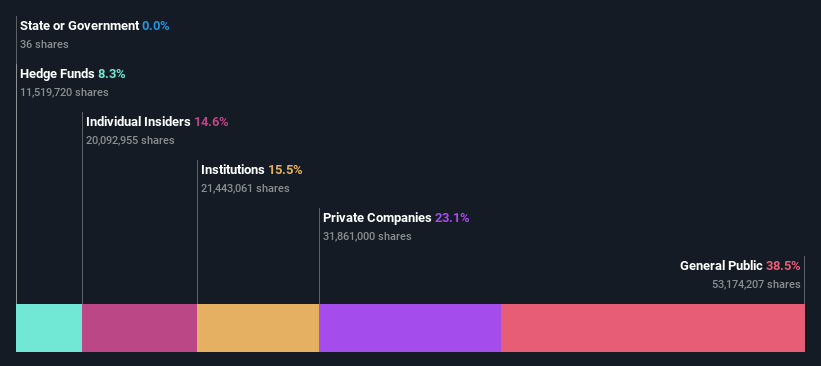

Insider Ownership: 14.5%

Revenue Growth Forecast: 11.1% p.a.

Intellect Design Arena, a growth company with high insider ownership, has recently launched its AI-driven WealthForce.AI platform in the Middle East and formed strategic alliances with HCLTech and Wipro to drive digital transformation in financial institutions. Despite an unstable dividend track record, Intellect's revenue is expected to grow at 11.1% annually, outpacing the Indian market. Earnings are forecasted to grow significantly at 22.38% per year over the next three years, highlighting strong profit potential.

- Get an in-depth perspective on Intellect Design Arena's performance by reading our analyst estimates report here.

- Our valuation report here indicates Intellect Design Arena may be overvalued.

JNK India (NSEI:JNKINDIA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: JNK India Limited is a heating equipment company involved in the design, engineering, manufacturing, supply, installation, and commissioning of process fired heaters, reformers, and cracking furnaces both domestically and internationally with a market cap of ₹37.57 billion.

Operations: The company's revenue primarily comes from Fired Heaters and Related Products, amounting to ₹5.32 billion.

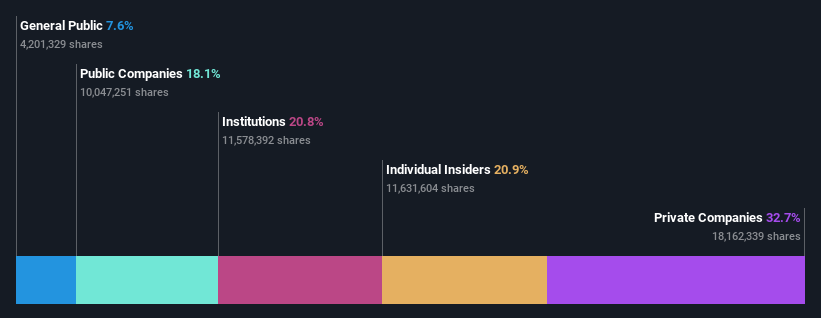

Insider Ownership: 21%

Revenue Growth Forecast: 32% p.a.

JNK India, with substantial insider ownership, is forecasted to achieve significant earnings growth of 33.71% annually over the next three years, outpacing the Indian market. Recent achievements include being added to the S&P Global BMI Index and securing major orders from Mundra Petrochem and JNK Global Co. Ltd., enhancing its market footprint in India and the USA. Despite some insider selling, overall sentiment remains positive with more shares bought than sold recently.

- Unlock comprehensive insights into our analysis of JNK India stock in this growth report.

- The analysis detailed in our JNK India valuation report hints at an inflated share price compared to its estimated value.

S H Kelkar (NSEI:SHK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: S H Kelkar and Company Limited, with a market cap of ₹41.58 billion, manufactures and supplies fragrances, flavors, and aroma ingredients in India through its subsidiaries.

Operations: The company's revenue segments include ₹2.59 billion from flavors and ₹22.08 billion from fragrances.

Insider Ownership: 38%

Revenue Growth Forecast: 11.1% p.a.

S H Kelkar, with significant insider ownership, is expanding its fragrance and flavor formulation facility at Vanawate, Raigad, to replace leased factories in Mulund. This INR 800 million capex aims to enhance operational stability. Despite a recent net loss of INR 865.8 million for Q1 2024 due to large one-off items and lower profit margins (0.6% vs. 3.9% last year), the company forecasts robust earnings growth of 44.88% annually over the next three years.

- Delve into the full analysis future growth report here for a deeper understanding of S H Kelkar.

- Our expertly prepared valuation report S H Kelkar implies its share price may be too high.

Summing It All Up

- Take a closer look at our Fast Growing Indian Companies With High Insider Ownership list of 93 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Intellect Design Arena, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:INTELLECT

Intellect Design Arena

Provides software development and related services for banking, insurance, and other financial services in India and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives