Here's Why Jash Engineering (NSE:JASH) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Jash Engineering (NSE:JASH). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Jash Engineering

Jash Engineering's Improving Profits

Over the last three years, Jash Engineering has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Jash Engineering has grown its trailing twelve month EPS from ₹25.78 to ₹26.95, in the last year. That amounts to a small improvement of 4.5%.

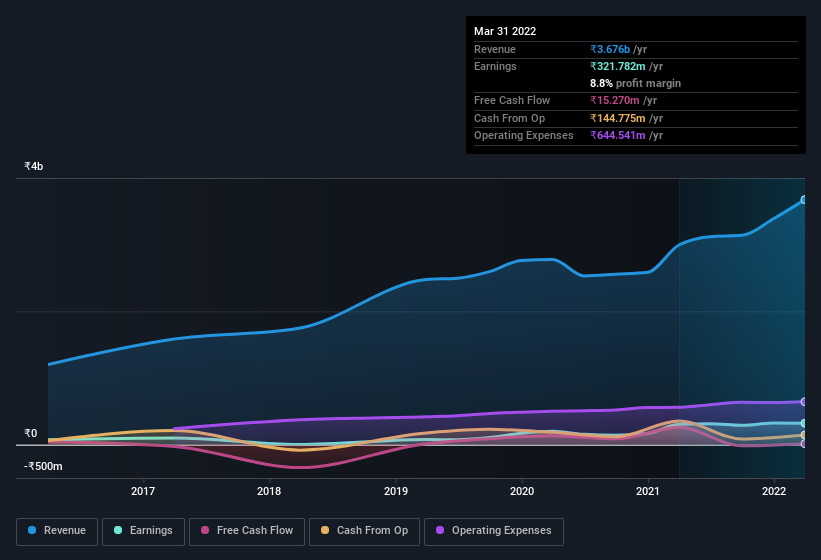

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the revenue front, Jash Engineering has done well over the past year, growing revenue by 23% to ₹3.7b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Jash Engineering is no giant, with a market capitalisation of ₹7.8b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Jash Engineering Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Jash Engineering insiders own a meaningful share of the business. Indeed, with a collective holding of 55%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. To give you an idea, the value of insiders' holdings in the business are valued at ₹4.3b at the current share price. That's nothing to sneeze at!

Should You Add Jash Engineering To Your Watchlist?

One important encouraging feature of Jash Engineering is that it is growing profits. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. The combination definitely favoured by investors so consider keeping the company on a watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Jash Engineering you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JASH

Jash Engineering

Manufactures, trades in, and sells various engineering products for general engineering, water and wastewater, power plant, and bulk solids handling industries in India and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.