- India

- /

- Construction

- /

- NSEI:IRB

Some Confidence Is Lacking In IRB Infrastructure Developers Limited's (NSE:IRB) P/S

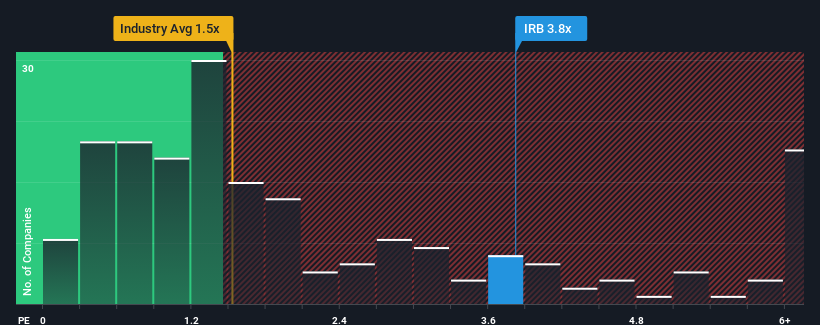

When close to half the companies in the Construction industry in India have price-to-sales ratios (or "P/S") below 1.5x, you may consider IRB Infrastructure Developers Limited (NSE:IRB) as a stock to avoid entirely with its 3.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for IRB Infrastructure Developers

What Does IRB Infrastructure Developers' Recent Performance Look Like?

IRB Infrastructure Developers could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think IRB Infrastructure Developers' future stacks up against the industry? In that case, our free report is a great place to start .How Is IRB Infrastructure Developers' Revenue Growth Trending?

IRB Infrastructure Developers' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 8.0% gain to the company's revenues. Revenue has also lifted 26% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 9.1% as estimated by the five analysts watching the company. With the industry predicted to deliver 12% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that IRB Infrastructure Developers' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On IRB Infrastructure Developers' P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that IRB Infrastructure Developers currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware IRB Infrastructure Developers is showing 4 warning signs in our investment analysis, and 2 of those are a bit unpleasant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IRB

IRB Infrastructure Developers

Engages in the infrastructure development business in India.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives