- India

- /

- Construction

- /

- NSEI:IRB

IRB Infrastructure Developers Limited's (NSE:IRB) Business Is Yet to Catch Up With Its Share Price

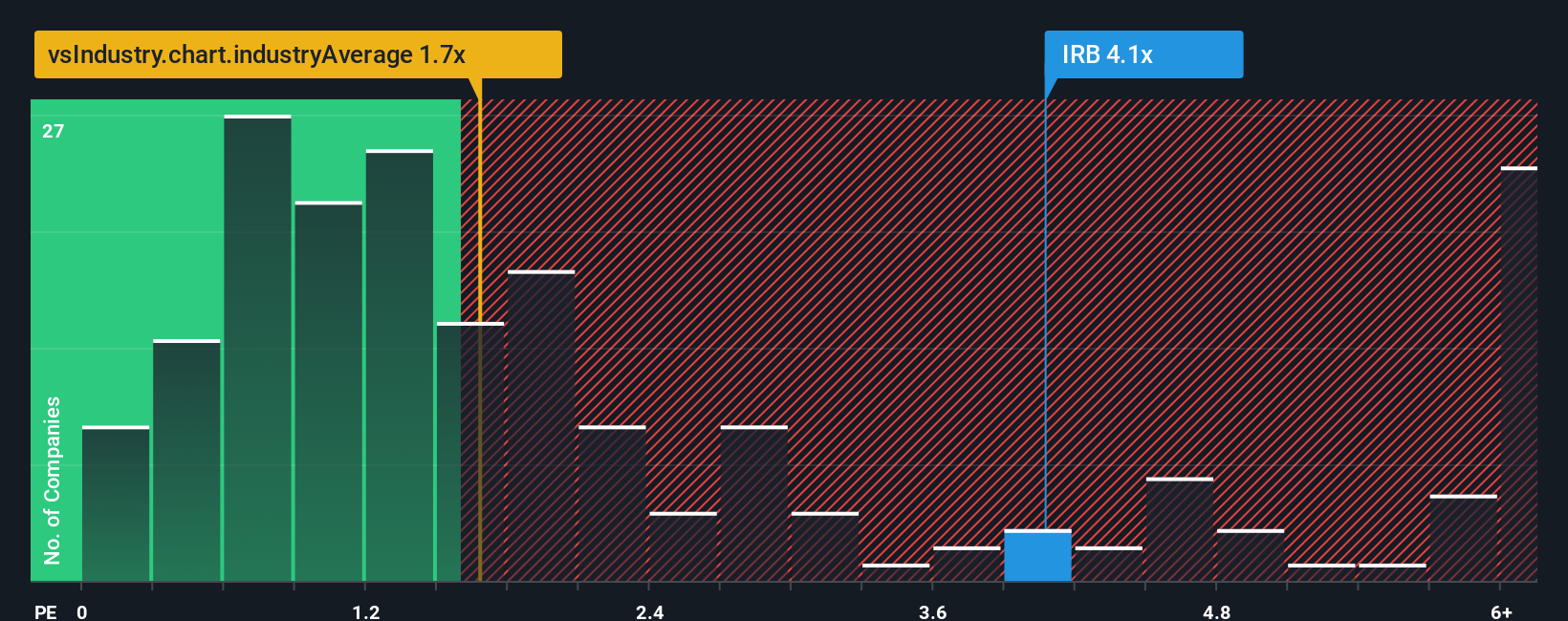

When you see that almost half of the companies in the Construction industry in India have price-to-sales ratios (or "P/S") below 1.7x, IRB Infrastructure Developers Limited (NSE:IRB) looks to be giving off strong sell signals with its 4.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for IRB Infrastructure Developers

What Does IRB Infrastructure Developers' P/S Mean For Shareholders?

IRB Infrastructure Developers hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think IRB Infrastructure Developers' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For IRB Infrastructure Developers?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like IRB Infrastructure Developers' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.7%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 22% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 10% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 14% each year, which is noticeably more attractive.

In light of this, it's alarming that IRB Infrastructure Developers' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From IRB Infrastructure Developers' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've concluded that IRB Infrastructure Developers currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 4 warning signs for IRB Infrastructure Developers (2 don't sit too well with us!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:IRB

IRB Infrastructure Developers

Engages in the infrastructure development business in India.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives