- Taiwan

- /

- Entertainment

- /

- TPEX:5478

Undiscovered Gems with Strong Fundamentals This November 2024

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic data, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 reach record highs before retreating, while small-cap stocks demonstrated resilience. Amidst this backdrop of fluctuating market sentiment and cautious investment strategies, identifying stocks with strong fundamentals becomes crucial for navigating the complexities of today's financial landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Forth Smart Service | 21.94% | -8.16% | -16.02% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 15.25% | 15.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Jinghua Pharmaceutical Group | 0.90% | 5.39% | 47.06% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 2.80% | 17.08% | -4.11% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Interarch Building Products (NSEI:INTERARCH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Interarch Building Products Limited offers pre-engineered steel construction solutions in India with a market capitalization of ₹29.57 billion.

Operations: The primary revenue stream for Interarch Building Products comes from its building products segment, which generated ₹13.30 billion. The company has a market capitalization of ₹29.57 billion.

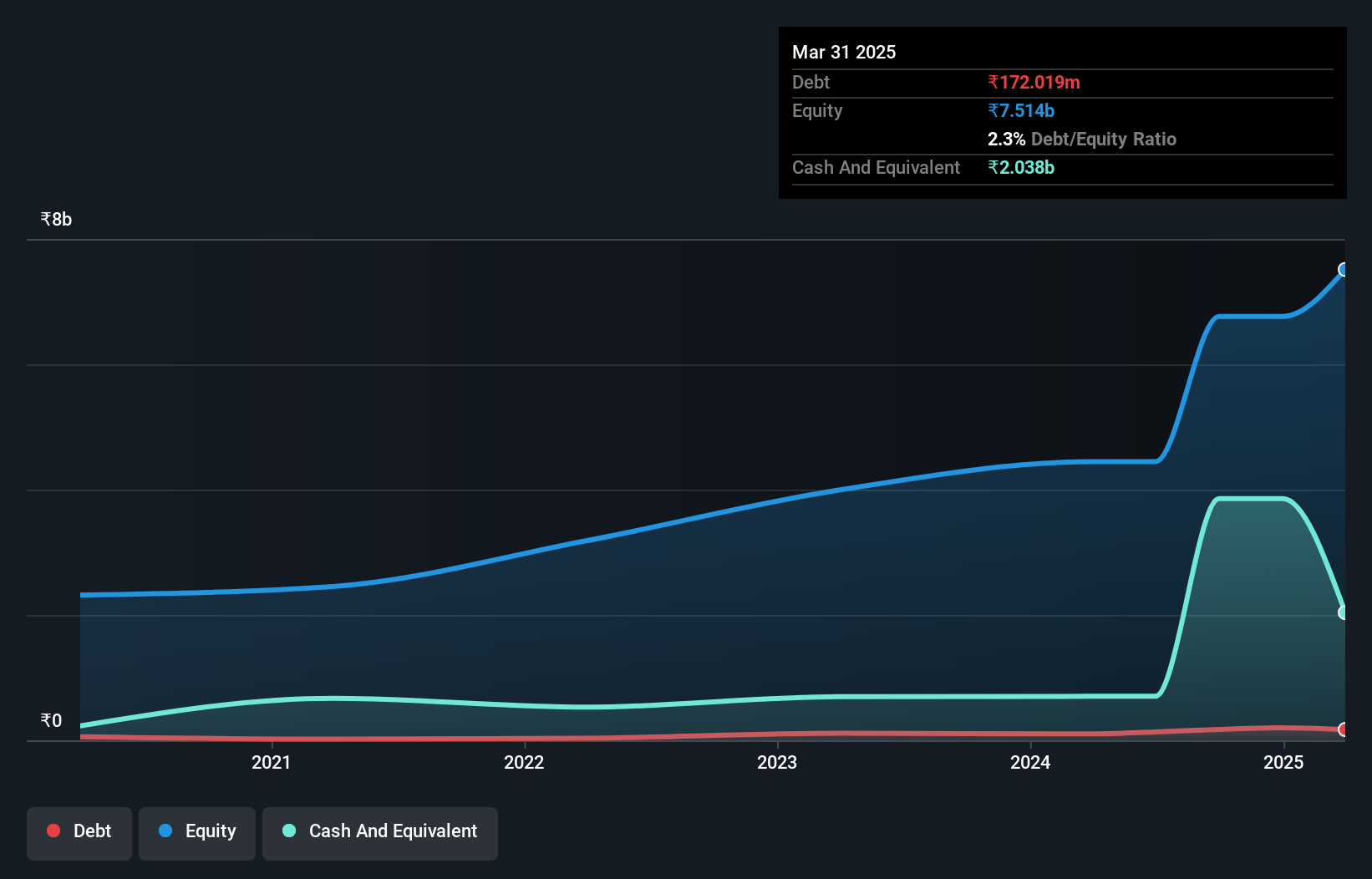

Interarch Building Products, a notable player in the construction sector, has been making waves with its recent financial performance and strategic expansions. Over the past five years, earnings have surged by 28% annually, underscoring the company's robust growth trajectory. Despite this impressive growth rate, it lagged behind the broader construction industry's 37% increase last year. Interarch's recent acquisition of land in Gujarat for INR 70 million aims to bolster its production capacity and tap into emerging markets like semiconductors and renewable energy. With sales reaching INR 3.23 billion in Q2 2024 compared to INR 2.98 billion previously, Interarch demonstrates strong revenue momentum while trading at a value perceived as undervalued by over 30%.

- Click here to discover the nuances of Interarch Building Products with our detailed analytical health report.

Learn about Interarch Building Products' historical performance.

Orient Pharma (TPEX:4166)

Simply Wall St Value Rating: ★★★★★☆

Overview: Orient Pharma Co., Ltd. focuses on the research, development, manufacturing, and sales of pharmaceuticals both in Taiwan and globally with a market capitalization of approximately NT$8.21 billion.

Operations: Orient Pharma generates revenue primarily through its Global Business Division, contributing NT$162.25 million. The company's market capitalization stands at approximately NT$8.21 billion.

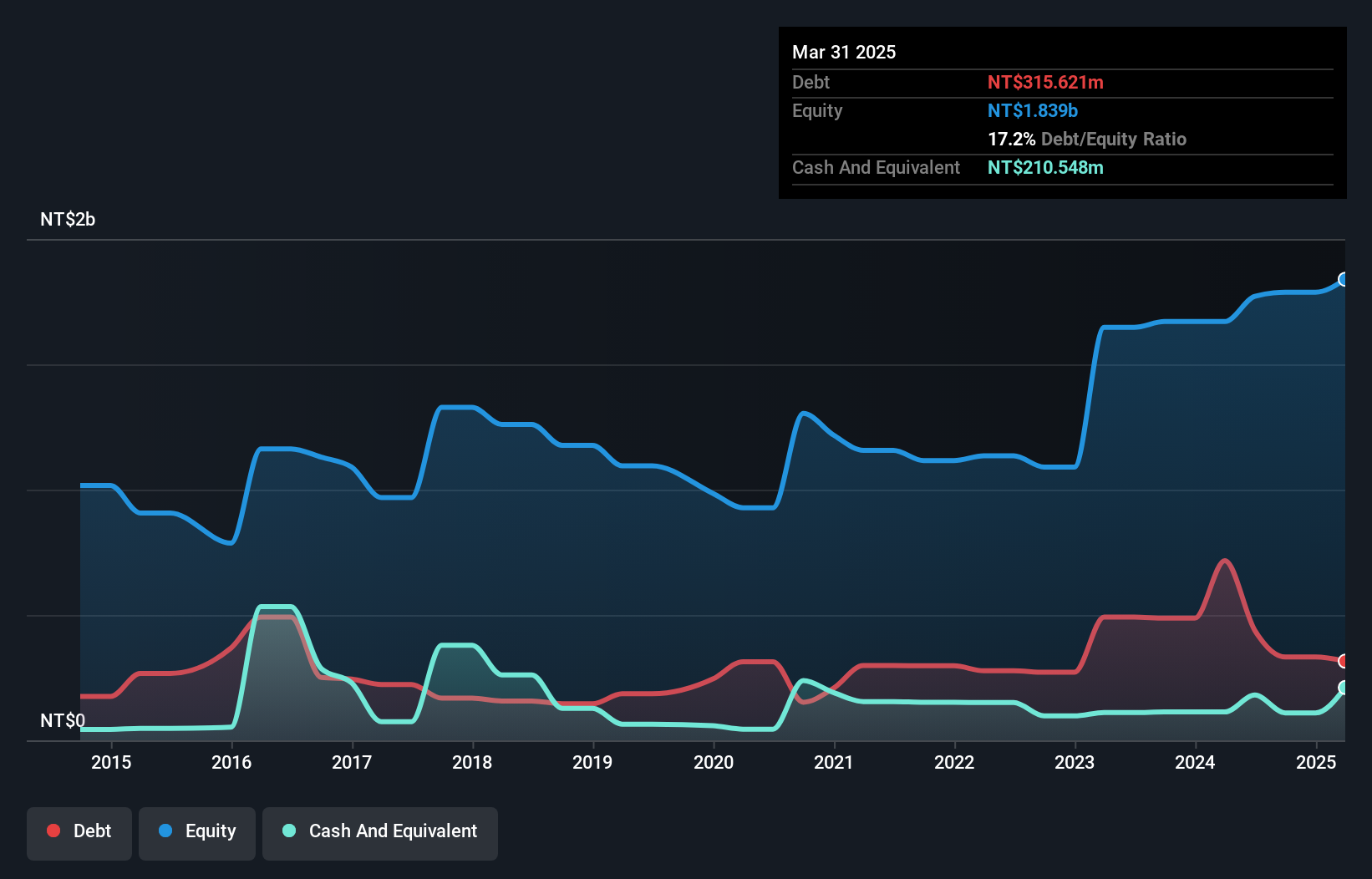

Orient Pharma, a smaller player in the pharmaceutical industry, has recently turned profitable, marking a significant shift. The company posted TWD 602.98 million in sales for the first half of 2024, up from TWD 427.23 million last year, with net income jumping to TWD 97.01 million from just TWD 0.203 million previously. Their debt to equity ratio has risen from 16.9% to 24.7% over five years; however, it's still satisfactory at a net debt to equity of 14.5%. With interest payments well covered by EBIT at a ratio of 12.8x, Orient Pharma seems positioned for stable growth ahead.

- Unlock comprehensive insights into our analysis of Orient Pharma stock in this health report.

Review our historical performance report to gain insights into Orient Pharma's's past performance.

Soft-World International (TPEX:5478)

Simply Wall St Value Rating: ★★★★★★

Overview: Soft-World International Corporation develops, operates, and distributes games in Taiwan and China with a market capitalization of NT$20.75 billion.

Operations: The primary revenue streams for Soft-World International include Soft-World and Soft-World (Hong Kong) at NT$3.10 billion and Neweb Technologies Co., Ltd. at NT$1.39 billion, followed by Yifan contributing NT$890.52 million. Notably, the company experienced a financial adjustment and write-off amounting to -NT$229.84 million, impacting its overall revenue figures.

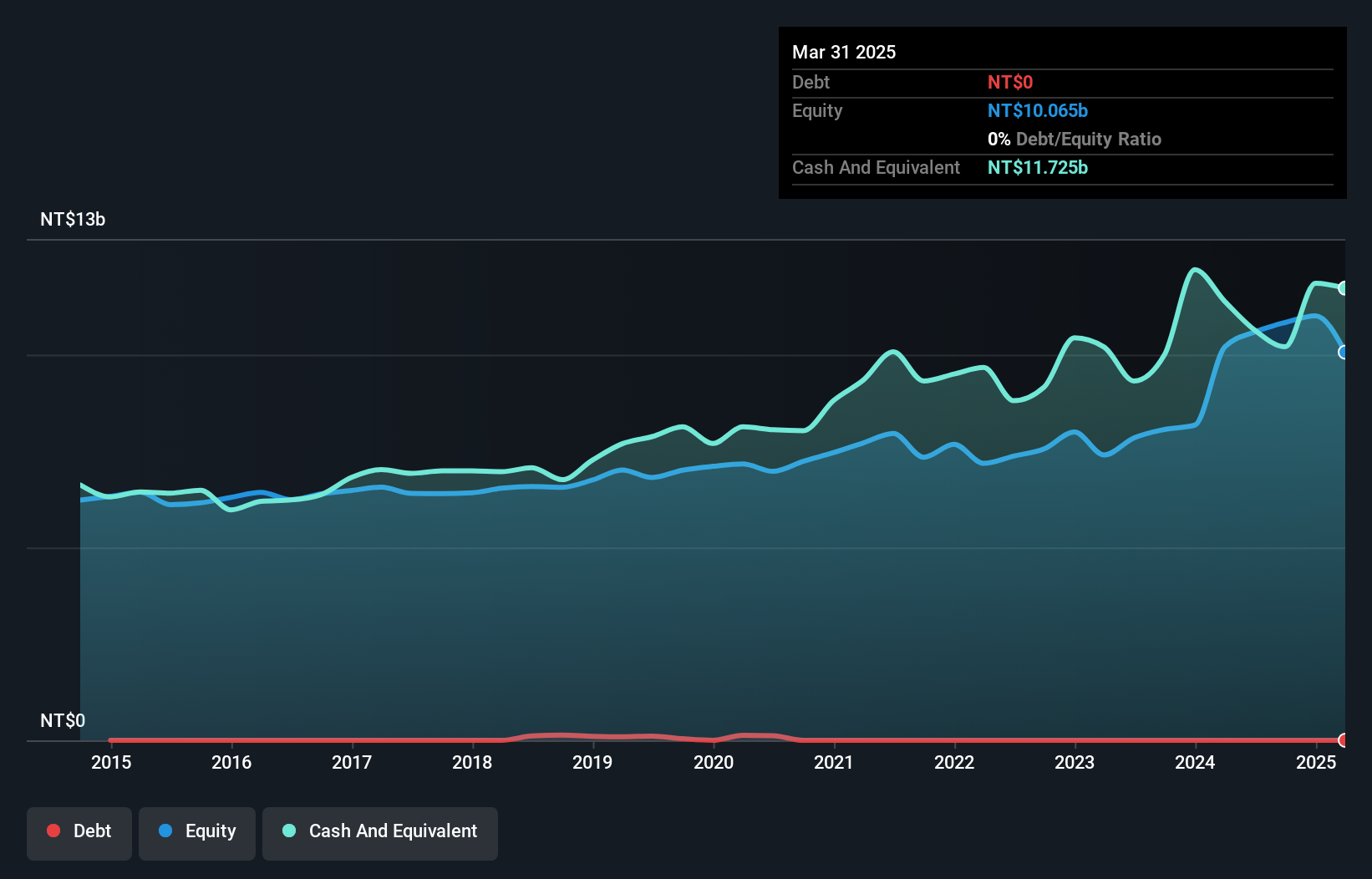

Soft-World International, a nimble player in the market, has showcased impressive financial resilience. The company is debt-free, having reduced its debt to equity ratio from 1.6% five years ago to zero today, reflecting prudent financial management. Recent earnings reports highlight a net income of TWD 394 million for Q2 2024, up from TWD 214.56 million the previous year, with basic EPS rising to TWD 2.64 from TWD 1.77. Despite not outpacing industry growth rates last year (10.1% vs industry’s 34.3%), it trades at nearly 80% below estimated fair value, indicating potential undervaluation in the market.

- Click here and access our complete health analysis report to understand the dynamics of Soft-World International.

Evaluate Soft-World International's historical performance by accessing our past performance report.

Where To Now?

- Investigate our full lineup of 300 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5478

Soft-World International

Develops, operates, and distributes games in Taiwan and China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives