- India

- /

- Construction

- /

- NSEI:INDIANHUME

Improved Earnings Required Before The Indian Hume Pipe Company Limited (NSE:INDIANHUME) Stock's 28% Jump Looks Justified

The Indian Hume Pipe Company Limited (NSE:INDIANHUME) shares have had a really impressive month, gaining 28% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 39%.

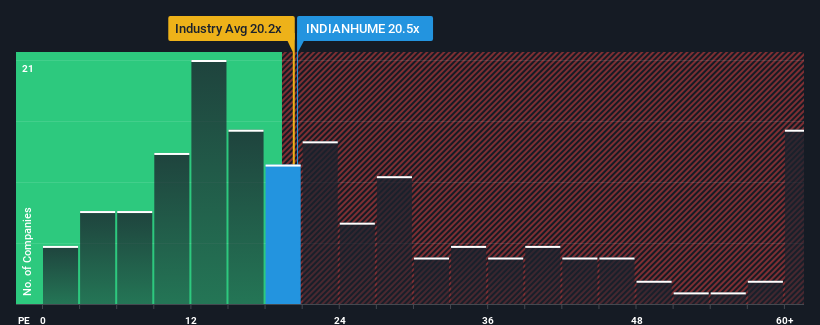

Even after such a large jump in price, Indian Hume Pipe's price-to-earnings (or "P/E") ratio of 20.5x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 26x and even P/E's above 50x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for Indian Hume Pipe as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Indian Hume Pipe

What Are Growth Metrics Telling Us About The Low P/E?

Indian Hume Pipe's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 97% last year. The latest three year period has also seen a 23% overall rise in EPS, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 32% during the coming year according to the one analyst following the company. With the market predicted to deliver 25% growth , that's a disappointing outcome.

In light of this, it's understandable that Indian Hume Pipe's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Indian Hume Pipe's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Indian Hume Pipe's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Indian Hume Pipe has 4 warning signs (and 3 which shouldn't be ignored) we think you should know about.

You might be able to find a better investment than Indian Hume Pipe. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDIANHUME

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives