- India

- /

- Trade Distributors

- /

- NSEI:INDIAMART

IndiaMART InterMESH Limited's (NSE:INDIAMART) Share Price Not Quite Adding Up

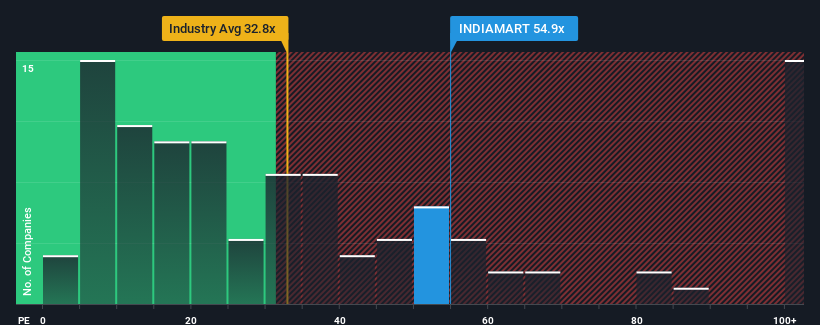

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 31x, you may consider IndiaMART InterMESH Limited (NSE:INDIAMART) as a stock to avoid entirely with its 54.9x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for IndiaMART InterMESH as its earnings have been rising slower than most other companies. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for IndiaMART InterMESH

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as IndiaMART InterMESH's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. The longer-term trend has been no better as the company has no earnings growth to show for over the last three years either. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 20% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 20% per year, which is not materially different.

In light of this, it's curious that IndiaMART InterMESH's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From IndiaMART InterMESH's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that IndiaMART InterMESH currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware IndiaMART InterMESH is showing 2 warning signs in our investment analysis, you should know about.

You might be able to find a better investment than IndiaMART InterMESH. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDIAMART

IndiaMART InterMESH

Operates an online business-to-business marketplace for business products and services in India and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.