- India

- /

- Trade Distributors

- /

- NSEI:INDIAMART

IndiaMART InterMESH Limited Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Predictions

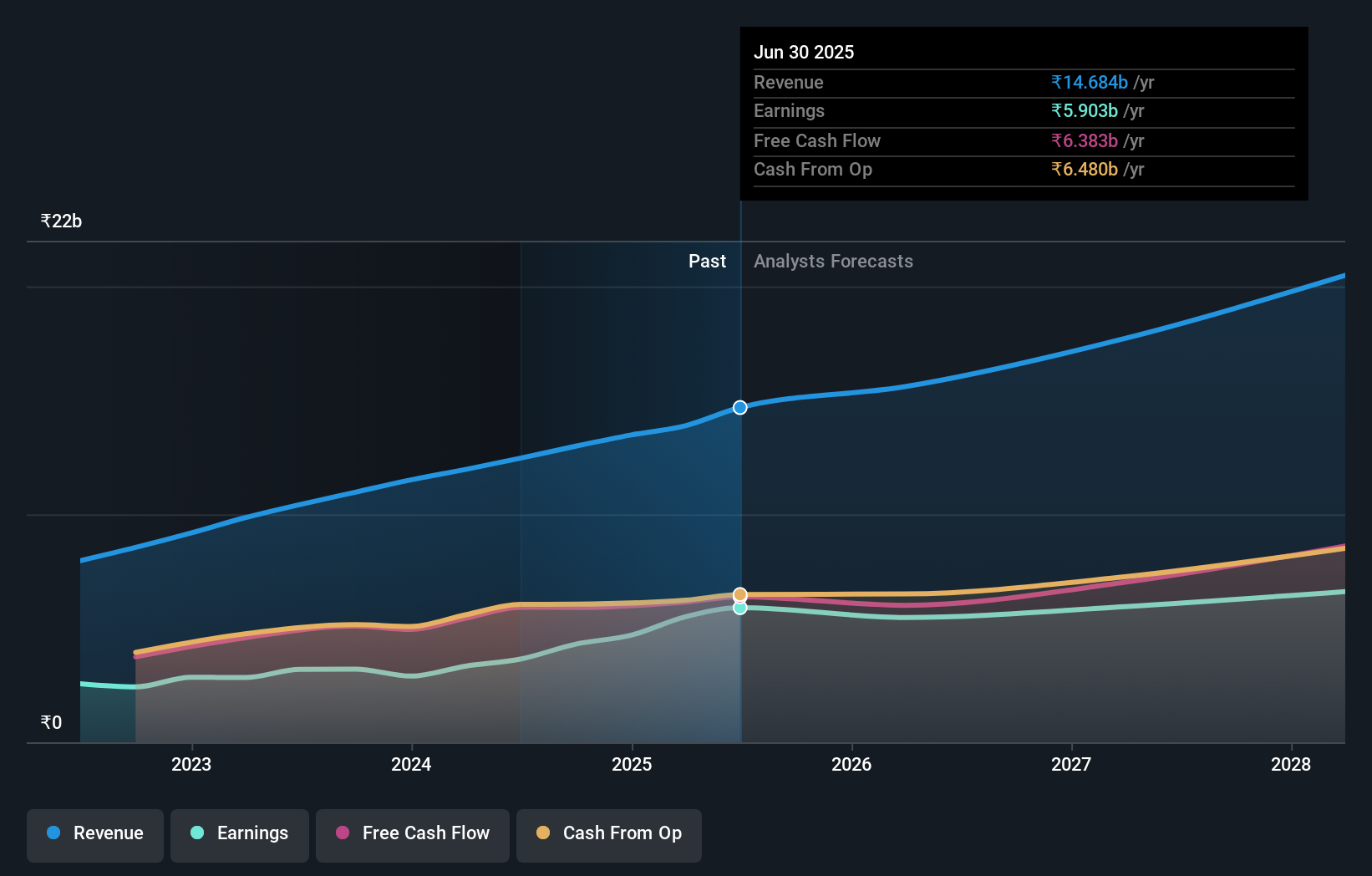

IndiaMART InterMESH Limited (NSE:INDIAMART) defied analyst predictions to release its quarterly results, which were ahead of market expectations. It was overall a positive result, with revenues beating expectations by 2.5% to hit ₹3.7b. IndiaMART InterMESH also reported a statutory profit of ₹25.52, which was an impressive 25% above what the analysts had forecast. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Taking into account the latest results, the current consensus from IndiaMART InterMESH's 17 analysts is for revenues of ₹15.6b in 2026. This would reflect a credible 6.2% increase on its revenue over the past 12 months. Statutory earnings per share are expected to decrease 6.7% to ₹91.83 in the same period. In the lead-up to this report, the analysts had been modelling revenues of ₹15.5b and earnings per share (EPS) of ₹87.23 in 2026. So the consensus seems to have become somewhat more optimistic on IndiaMART InterMESH's earnings potential following these results.

Check out our latest analysis for IndiaMART InterMESH

The consensus price target was unchanged at ₹2,536, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic IndiaMART InterMESH analyst has a price target of ₹3,800 per share, while the most pessimistic values it at ₹1,890. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that IndiaMART InterMESH's revenue growth is expected to slow, with the forecast 8.4% annualised growth rate until the end of 2026 being well below the historical 18% p.a. growth over the last five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 4.4% per year. So it's pretty clear that, while IndiaMART InterMESH's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around IndiaMART InterMESH's earnings potential next year. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. The consensus price target held steady at ₹2,536, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for IndiaMART InterMESH going out to 2028, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 2 warning signs for IndiaMART InterMESH that you should be aware of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDIAMART

IndiaMART InterMESH

Operates an online business-to-business marketplace for business products and services in India and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success