- India

- /

- Construction

- /

- NSEI:IL&FSENGG

IL&FS Engineering and Construction Company Limited (NSE:IL&FSENGG) Surges 30% Yet Its Low P/S Is No Reason For Excitement

Those holding IL&FS Engineering and Construction Company Limited (NSE:IL&FSENGG) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 101% following the latest surge, making investors sit up and take notice.

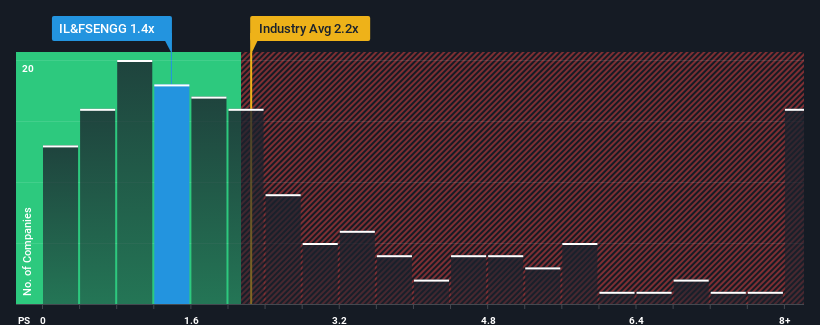

In spite of the firm bounce in price, IL&FS Engineering and Construction may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.4x, since almost half of all companies in the Construction industry in India have P/S ratios greater than 2.2x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for IL&FS Engineering and Construction

What Does IL&FS Engineering and Construction's P/S Mean For Shareholders?

Recent times have been quite advantageous for IL&FS Engineering and Construction as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on IL&FS Engineering and Construction's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, IL&FS Engineering and Construction would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 46% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 22% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we are not surprised that IL&FS Engineering and Construction is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Despite IL&FS Engineering and Construction's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of IL&FS Engineering and Construction confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for IL&FS Engineering and Construction (1 makes us a bit uncomfortable!) that you need to be mindful of.

If you're unsure about the strength of IL&FS Engineering and Construction's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IL&FSENGG

IL&FS Engineering and Construction

Engages in construction and infrastructure development, and project management businesses in India.

Imperfect balance sheet very low.

Market Insights

Community Narratives