- India

- /

- Electrical

- /

- NSEI:HIRECT

Hind Rectifiers Limited's (NSE:HIRECT) 34% Share Price Surge Not Quite Adding Up

Hind Rectifiers Limited (NSE:HIRECT) shares have had a really impressive month, gaining 34% after a shaky period beforehand. The last month tops off a massive increase of 286% in the last year.

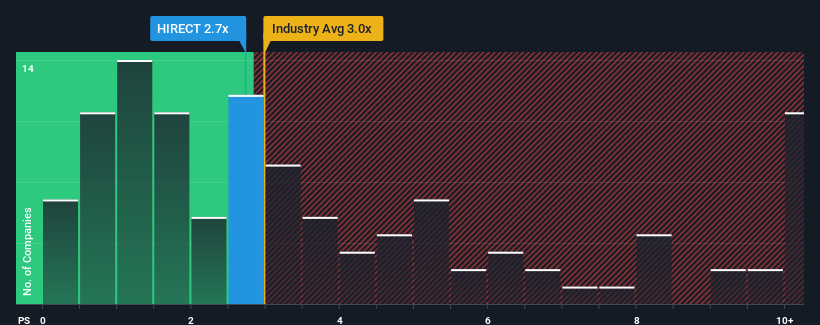

Although its price has surged higher, you could still be forgiven for feeling indifferent about Hind Rectifiers' P/S ratio of 2.7x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in India is also close to 3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Hind Rectifiers

How Hind Rectifiers Has Been Performing

Recent times have been quite advantageous for Hind Rectifiers as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Hind Rectifiers, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hind Rectifiers' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. Pleasingly, revenue has also lifted 55% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 32% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Hind Rectifiers is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

Hind Rectifiers' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Hind Rectifiers' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Before you take the next step, you should know about the 5 warning signs for Hind Rectifiers (2 make us uncomfortable!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hind Rectifiers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HIRECT

Hind Rectifiers

Engages in the designs, development, manufacture, and marketing of power semiconductor devices, power electronic equipment, and railway transportation equipment in India and internationally.

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives