- India

- /

- Construction

- /

- NSEI:HGINFRA

We Think H.G. Infra Engineering (NSE:HGINFRA) Can Stay On Top Of Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, H.G. Infra Engineering Limited (NSE:HGINFRA) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for H.G. Infra Engineering

What Is H.G. Infra Engineering's Debt?

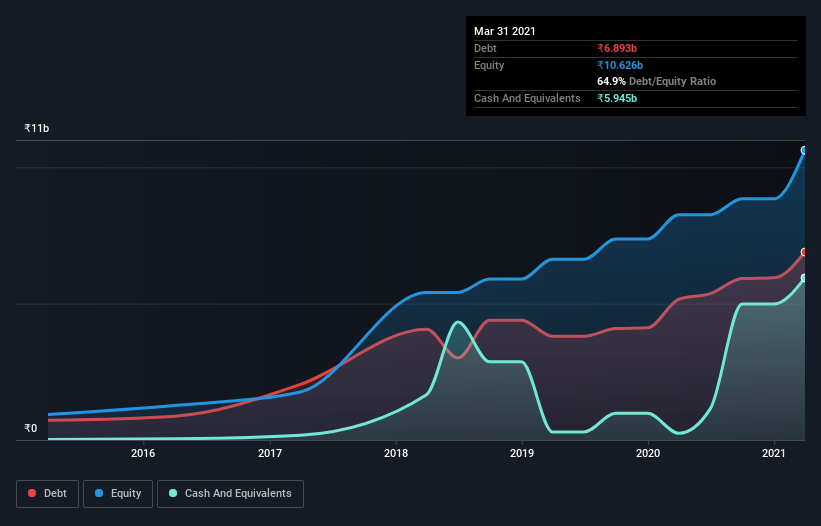

The image below, which you can click on for greater detail, shows that at March 2021 H.G. Infra Engineering had debt of ₹6.89b, up from ₹5.16b in one year. On the flip side, it has ₹5.94b in cash leading to net debt of about ₹947.9m.

How Healthy Is H.G. Infra Engineering's Balance Sheet?

The latest balance sheet data shows that H.G. Infra Engineering had liabilities of ₹9.74b due within a year, and liabilities of ₹6.47b falling due after that. Offsetting these obligations, it had cash of ₹5.94b as well as receivables valued at ₹8.48b due within 12 months. So it has liabilities totalling ₹1.79b more than its cash and near-term receivables, combined.

Given H.G. Infra Engineering has a market capitalization of ₹21.7b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While H.G. Infra Engineering's low debt to EBITDA ratio of 0.19 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 4.3 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Importantly, H.G. Infra Engineering grew its EBIT by 41% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if H.G. Infra Engineering can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, H.G. Infra Engineering recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Both H.G. Infra Engineering's ability to to grow its EBIT and its net debt to EBITDA gave us comfort that it can handle its debt. But truth be told its conversion of EBIT to free cash flow had us nibbling our nails. Considering this range of data points, we think H.G. Infra Engineering is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that H.G. Infra Engineering is showing 3 warning signs in our investment analysis , and 2 of those are a bit concerning...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading H.G. Infra Engineering or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if H.G. Infra Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:HGINFRA

H.G. Infra Engineering

Engages in the engineering, procurement, and construction (EPC) business in India.

Good value with mediocre balance sheet.