- India

- /

- Construction

- /

- NSEI:HGINFRA

H.G. Infra Engineering Limited (NSE:HGINFRA) Shares Fly 25% But Investors Aren't Buying For Growth

Those holding H.G. Infra Engineering Limited (NSE:HGINFRA) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 78% in the last year.

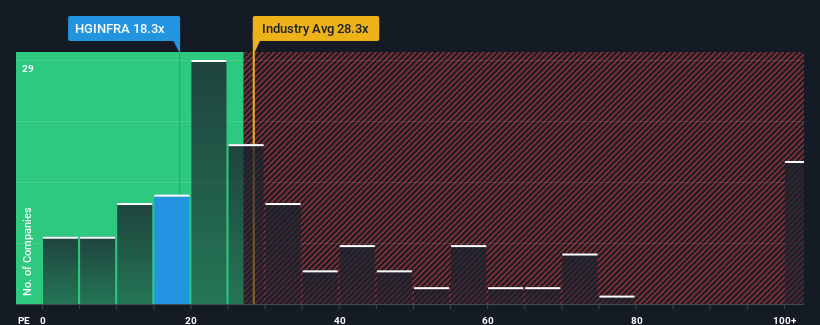

Although its price has surged higher, H.G. Infra Engineering may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.3x, since almost half of all companies in India have P/E ratios greater than 34x and even P/E's higher than 64x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

H.G. Infra Engineering hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for H.G. Infra Engineering

Does Growth Match The Low P/E?

H.G. Infra Engineering's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 2.3% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 51% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 11% each year over the next three years. That's shaping up to be materially lower than the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that H.G. Infra Engineering's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The latest share price surge wasn't enough to lift H.G. Infra Engineering's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that H.G. Infra Engineering maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 2 warning signs we've spotted with H.G. Infra Engineering.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if H.G. Infra Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HGINFRA

H.G. Infra Engineering

Engages in the engineering, procurement, and construction (EPC) business in India.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026