- India

- /

- Electrical

- /

- NSEI:HEG

Top 3 Stocks Estimated To Be Undervalued On The Indian Exchange In July 2024

Reviewed by Simply Wall St

The Indian stock market has shown robust growth, rising 2.4% in the past week and an impressive 46% over the last year, with earnings expected to grow by 16% annually. In such a thriving market, identifying stocks that are potentially undervalued could offer interesting opportunities for investors looking for value in a rapidly growing environment.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shyam Metalics and Energy (NSEI:SHYAMMETL) | ₹720.30 | ₹1021.98 | 29.5% |

| HEG (NSEI:HEG) | ₹2264.60 | ₹3313.92 | 31.7% |

| Updater Services (NSEI:UDS) | ₹307.20 | ₹538.29 | 42.9% |

| Vedanta (NSEI:VEDL) | ₹473.85 | ₹746.44 | 36.5% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹287.10 | ₹506.60 | 43.3% |

| Strides Pharma Science (NSEI:STAR) | ₹936.45 | ₹1664.05 | 43.7% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹520.25 | ₹908.94 | 42.8% |

| Delhivery (NSEI:DELHIVERY) | ₹395.55 | ₹747.23 | 47.1% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3281.70 | ₹5760.95 | 43% |

| PVR INOX (NSEI:PVRINOX) | ₹1467.85 | ₹2547.30 | 42.4% |

We'll examine a selection from our screener results

HEG (NSEI:HEG)

Overview: HEG Limited is a company that specializes in manufacturing and selling graphite electrodes both domestically and internationally, with a market capitalization of approximately ₹87.40 billion.

Operations: The company generates ₹236.11 billion from its graphite electrodes and other carbon products, along with ₹0.34 billion from its power segment.

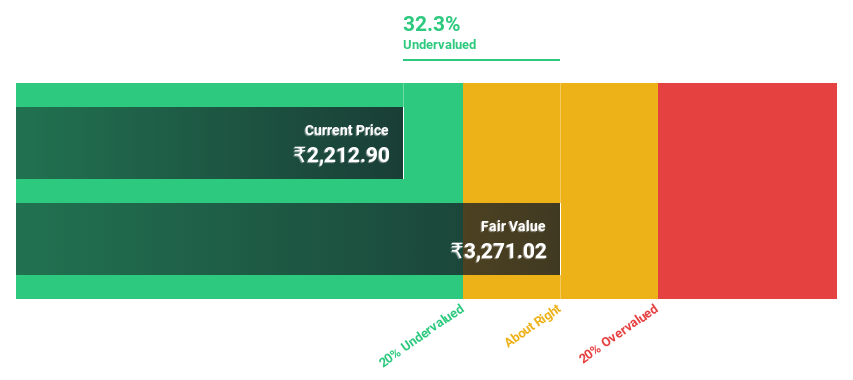

Estimated Discount To Fair Value: 31.7%

HEG Limited, priced at ₹2264.6, trades significantly below its fair value of ₹3313.92, reflecting a potential undervaluation based on cash flows. Despite a challenging year with reduced profit margins from 21.6% to 13%, HEG forecasts robust earnings growth at 42.58% annually over the next three years, outpacing the Indian market's average. Recent strategic expansions include forming HEG Graphite Limited to enhance its manufacturing capabilities in graphite electrodes, aligning with its revenue growth projections of 22.3% per year.

- Our comprehensive growth report raises the possibility that HEG is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of HEG stock in this financial health report.

Patanjali Foods (NSEI:PATANJALI)

Overview: Patanjali Foods Limited operates in India, specializing in processing oil seeds and refining crude oil for edible purposes, with a market capitalization of approximately ₹59.66 billion.

Operations: Patanjali Foods generates revenue primarily through its edible oils and food & FMCG segments, with ₹2.24 billion from edible oils and ₹0.96 billion from food and FMCG products.

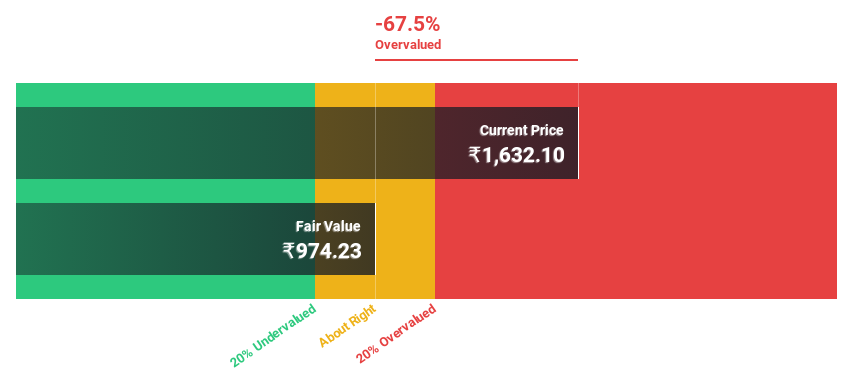

Estimated Discount To Fair Value: 10.2%

Patanjali Foods, priced at ₹1648.3, is considered undervalued with its market price standing below the estimated fair value of ₹1836.32. The company's earnings are projected to grow by 38.41% annually, surpassing the Indian market's average growth rate. Recent strategic decisions include expanding into non-food sectors and potential acquisitions aimed at diversifying its product range, which could enhance revenue streams despite current revenue growth forecasts being modest at 10.6% per year compared to higher industry averages.

- Our earnings growth report unveils the potential for significant increases in Patanjali Foods' future results.

- Get an in-depth perspective on Patanjali Foods' balance sheet by reading our health report here.

VRL Logistics (NSEI:VRLLOG)

Overview: VRL Logistics Limited is a logistics and transport company with operations in India and internationally, boasting a market cap of approximately ₹50.50 billion.

Operations: The primary revenue segment for the company is goods transport, generating ₹29.10 billion.

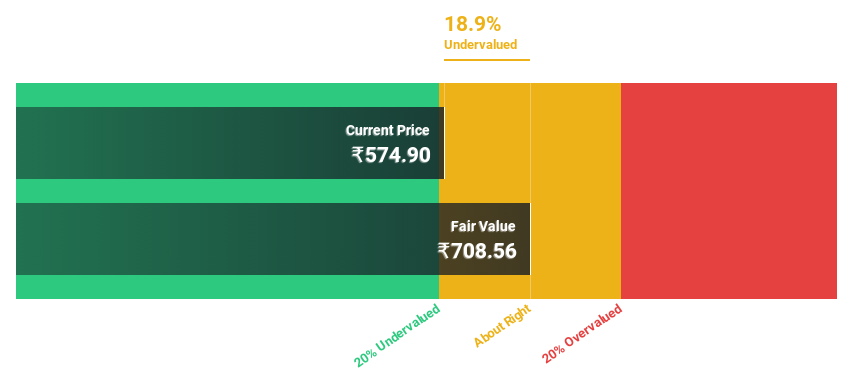

Estimated Discount To Fair Value: 18.8%

VRL Logistics, currently priced at ₹577.3, is trading below its fair value estimate of ₹710.63, reflecting a potential undervaluation based on cash flows. Despite recent earnings showing a decrease with net income dropping significantly from the previous year to INR 888.51 million, VRLLOG's future looks promising with an expected earnings growth of 30.2% annually over the next three years and revenue forecasted to rise by 12% annually—outpacing the Indian market average of 9.7%. However, profit margins have declined to 3.1% from last year's 6.3%.

- The analysis detailed in our VRL Logistics growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of VRL Logistics.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 14 Undervalued Indian Stocks Based On Cash Flows now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HEG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:HEG

HEG

Manufactures and sells graphite electrodes in India and internationally.

Flawless balance sheet with high growth potential and pays a dividend.