In the last week, the Indian market has stayed flat, yet it is up 44% over the past year with earnings expected to grow by 17% per annum in the next few years. In this dynamic environment, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Pearl Global Industries | 72.24% | 19.89% | 41.91% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.66% | ★★★★★☆ |

| Network People Services Technologies | 0.24% | 81.82% | 86.35% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Jai (NSEI:JAICORPLTD)

Simply Wall St Value Rating: ★★★★★★

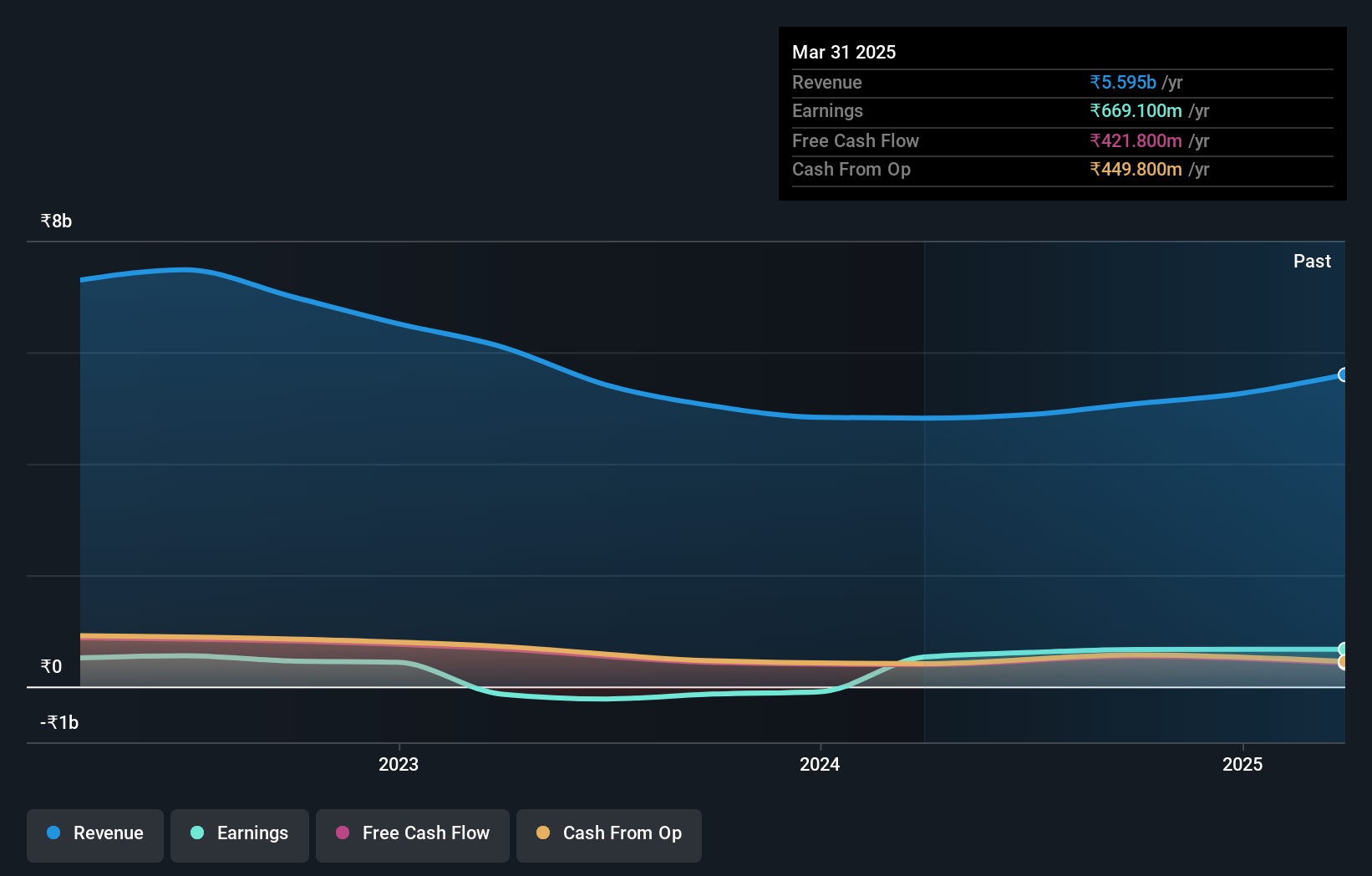

Overview: Jai Corp Limited primarily engages in the plastic processing business in India and internationally, with a market cap of ₹71.54 billion.

Operations: Jai Corp Limited generates revenue primarily from its plastic processing segment, which brought in ₹4.65 billion, followed by smaller contributions from real estate at ₹35.68 million and steel at ₹3.21 million.

Jai Corp Limited has made significant strides, becoming profitable this year with high-quality earnings. The company is debt-free, a notable improvement from five years ago when its debt to equity ratio was 0.03%. Recent performance includes net income of INR 137.3 million for Q1 2024, up from INR 55.3 million the previous year. Jai Corp announced a share repurchase program to buy back up to 2,944,415 shares for INR 1,177.77 million by September 20, aimed at enhancing shareholder value and return on equity.

- Delve into the full analysis health report here for a deeper understanding of Jai.

Review our historical performance report to gain insights into Jai's's past performance.

Maharashtra Scooters (NSEI:MAHSCOOTER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Maharashtra Scooters Ltd. manufactures and sells pressure die casting dies, jigs, fixtures, and die casting components primarily for the two and three-wheeler industry in India with a market cap of ₹139.28 billion.

Operations: Maharashtra Scooters Ltd. generates revenue primarily from investments (₹2.14 billion) and manufacturing activities (₹108.10 million).

Maharashtra Scooters, a debt-free entity for the past five years, has demonstrated robust financial health. Earnings have grown at 19.3% annually over the last half-decade, with recent earnings growth at 6.6%, though not matching the Capital Markets industry's 63.2%. The company reported Q1 revenue of INR 85.7 million and net income of INR 82.6 million, significantly up from INR 52.6 million and INR 4.8 million respectively a year ago. An interim dividend of INR 110 per share was approved recently, reflecting strong shareholder returns.

- Take a closer look at Maharashtra Scooters' potential here in our health report.

Explore historical data to track Maharashtra Scooters' performance over time in our Past section.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

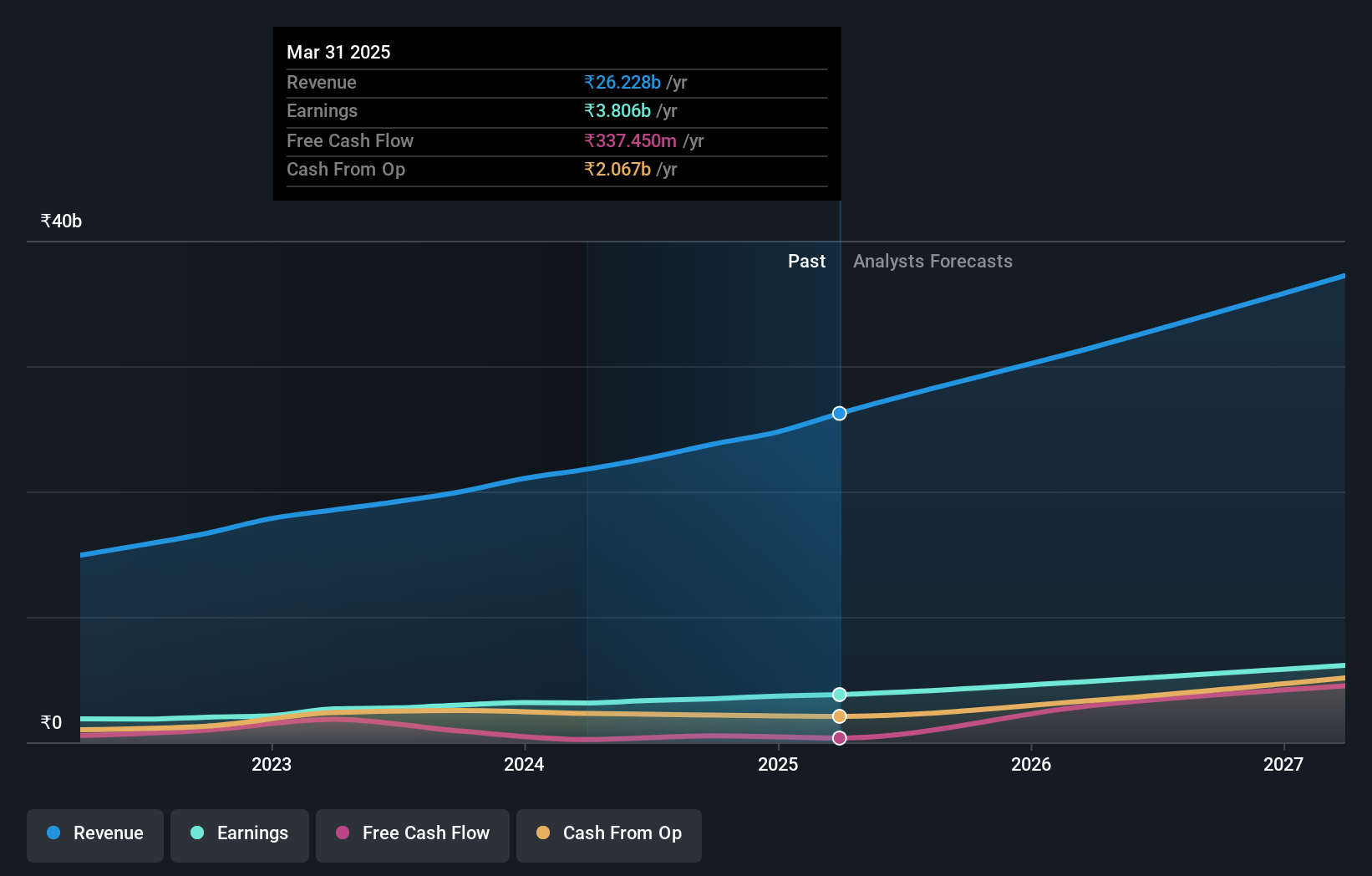

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand; it has a market cap of ₹142.54 billion.

Operations: Marksans Pharma generates revenue primarily from its pharmaceutical formulations segment, which reported ₹22.68 billion. The company's financial performance is influenced by its international market presence across multiple regions.

Marksans Pharma has shown impressive growth, with earnings increasing 21.7% over the past year, outpacing the pharmaceutical industry’s 19.2%. The company’s debt to equity ratio improved from 19.9% to 11.7% in five years, reflecting stronger financial health. Recent USFDA inspection closure at its Goa facility signals operational robustness, while Q1 FY25 results highlighted net income of ₹887 million compared to ₹687 million a year ago and diluted EPS rising from ₹1.52 to ₹1.96.

Where To Now?

- Embark on your investment journey to our 480 Indian Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MARKSANS

Marksans Pharma

Engages in the research, manufacturing, marketing, and sale of pharmaceutical formulations in the United States, North America, Europe, the United Kingdom, Australia, New Zealand, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026