- India

- /

- Electrical

- /

- NSEI:HAVELLS

Havells India Limited's (NSE:HAVELLS) Business Is Trailing The Market But Its Shares Aren't

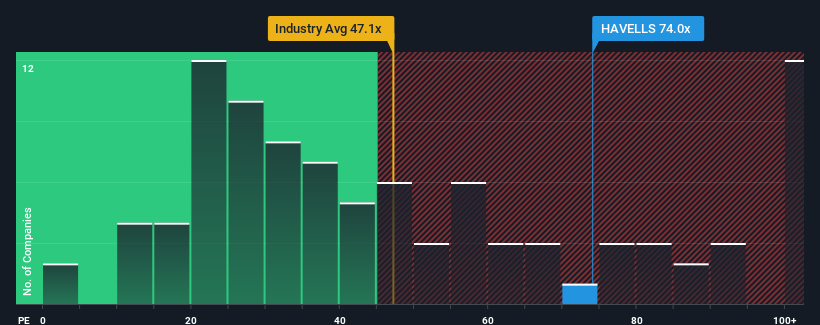

With a price-to-earnings (or "P/E") ratio of 74x Havells India Limited (NSE:HAVELLS) may be sending very bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 30x and even P/E's lower than 17x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent earnings growth for Havells India has been in line with the market. One possibility is that the P/E is high because investors think this modest earnings performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Havells India

Does Growth Match The High P/E?

Havells India's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 20% last year. EPS has also lifted 18% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 18% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% per annum, which is not materially different.

With this information, we find it interesting that Havells India is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Havells India's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 1 warning sign for Havells India that we have uncovered.

Of course, you might also be able to find a better stock than Havells India. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Havells India, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Havells India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HAVELLS

Havells India

A fast-moving electrical goods company, manufactures, trades in, and sells various consumer electrical and electronic products in India and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives