- India

- /

- Aerospace & Defense

- /

- NSEI:GRSE

Should You Be Adding Garden Reach Shipbuilders & Engineers (NSE:GRSE) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Garden Reach Shipbuilders & Engineers (NSE:GRSE). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Garden Reach Shipbuilders & Engineers

Garden Reach Shipbuilders & Engineers' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Garden Reach Shipbuilders & Engineers managed to grow EPS by 14% per year, over three years. That's a good rate of growth, if it can be sustained.

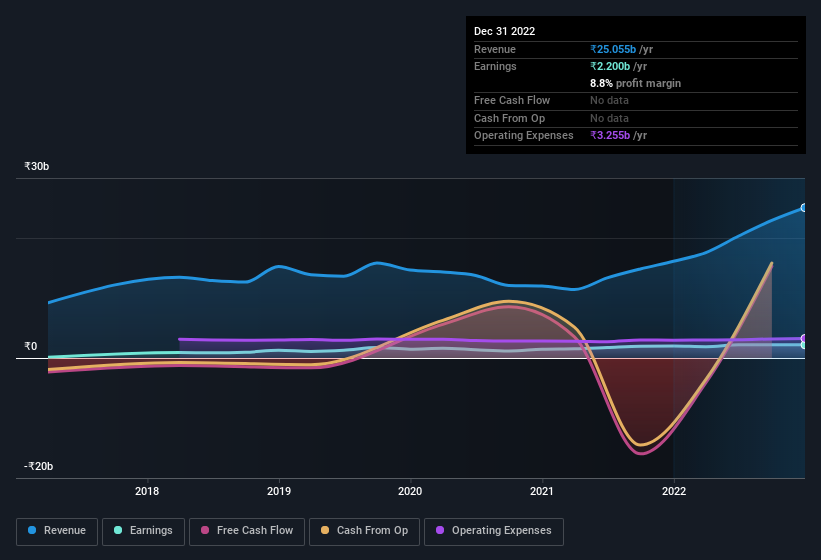

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Garden Reach Shipbuilders & Engineers did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Garden Reach Shipbuilders & Engineers Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. For companies with market capitalisations between ₹33b and ₹132b, like Garden Reach Shipbuilders & Engineers, the median CEO pay is around ₹35m.

Garden Reach Shipbuilders & Engineers' CEO took home a total compensation package of ₹5.6m in the year prior to March 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Garden Reach Shipbuilders & Engineers To Your Watchlist?

One positive for Garden Reach Shipbuilders & Engineers is that it is growing EPS. That's nice to see. Not only that, but the CEO is paid quite reasonably, which should prompt investors to feel more trusting of the board of directors. So based on its merits, the stock deserves further research, if not an addition to your watchlist. However, before you get too excited we've discovered 1 warning sign for Garden Reach Shipbuilders & Engineers that you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GRSE

Garden Reach Shipbuilders & Engineers

Engages in the design and construction of war ships in India.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives