We Think Greaves Cotton (NSE:GREAVESCOT) Is Taking Some Risk With Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Greaves Cotton Limited (NSE:GREAVESCOT) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Greaves Cotton

How Much Debt Does Greaves Cotton Carry?

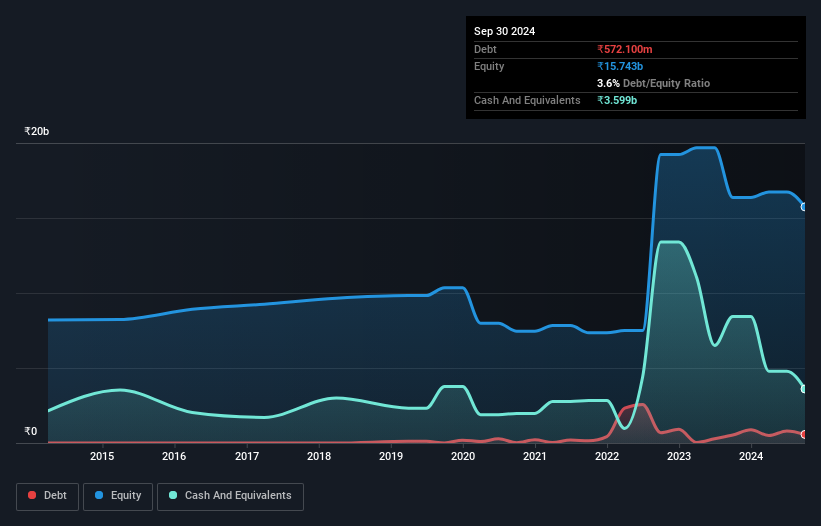

As you can see below, at the end of September 2024, Greaves Cotton had ₹572.1m of debt, up from ₹528.9m a year ago. Click the image for more detail. However, its balance sheet shows it holds ₹3.60b in cash, so it actually has ₹3.03b net cash.

A Look At Greaves Cotton's Liabilities

According to the last reported balance sheet, Greaves Cotton had liabilities of ₹7.84b due within 12 months, and liabilities of ₹965.5m due beyond 12 months. Offsetting this, it had ₹3.60b in cash and ₹2.57b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹2.64b.

Of course, Greaves Cotton has a market capitalization of ₹37.0b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Greaves Cotton also has more cash than debt, so we're pretty confident it can manage its debt safely.

The modesty of its debt load may become crucial for Greaves Cotton if management cannot prevent a repeat of the 90% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Greaves Cotton's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Greaves Cotton may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Greaves Cotton burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Greaves Cotton has ₹3.03b in net cash. So although we see some areas for improvement, we're not too worried about Greaves Cotton's balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Greaves Cotton you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GREAVESCOT

Greaves Cotton

Operates engineering and mobility retail business in India, Middle East, Africa, Southeast Asia, and internationally.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives