A Piece Of The Puzzle Missing From Greaves Cotton Limited's (NSE:GREAVESCOT) 33% Share Price Climb

Greaves Cotton Limited (NSE:GREAVESCOT) shares have continued their recent momentum with a 33% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 82% in the last year.

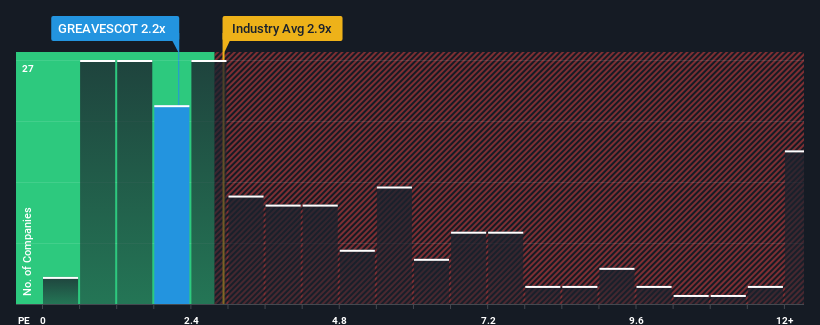

Even after such a large jump in price, Greaves Cotton may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.2x, considering almost half of all companies in the Machinery industry in India have P/S ratios greater than 2.9x and even P/S higher than 6x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Greaves Cotton

How Has Greaves Cotton Performed Recently?

Recent times haven't been great for Greaves Cotton as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Greaves Cotton will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Greaves Cotton would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 66% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the dual analysts following the company. With the industry only predicted to deliver 16%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Greaves Cotton's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Greaves Cotton's P/S?

Greaves Cotton's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Greaves Cotton currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Greaves Cotton (3 are a bit unpleasant!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GREAVESCOT

Greaves Cotton

Operates engineering and mobility retail business in India, Middle East, Africa, Southeast Asia, and internationally.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives