Force Motors' (NSE:FORCEMOT) Dividend Is Being Reduced To ₹5.00

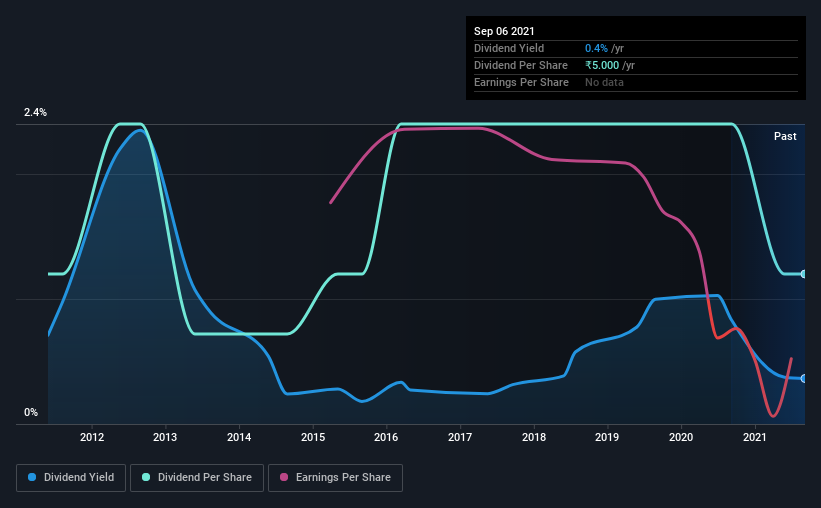

Force Motors Limited (NSE:FORCEMOT) has announced it will be reducing its dividend payable on the 28th of October to ₹5.00. This payment takes the dividend yield to 0.4%, which only provides a modest boost to overall returns.

View our latest analysis for Force Motors

Force Motors' Distributions May Be Difficult To Sustain

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Even in the absence of profits, Force Motors is paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Over the next year, EPS might fall by 77.0% based on recent performance. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. There hasn't been much of a change in the dividend over the last 10. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Force Motors' EPS has fallen by approximately 77% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

We're Not Big Fans Of Force Motors' Dividend

In summary, it's not great to see that the dividend is being cut, but it is probably understandable given that the current payment level was quite high. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Overall, the dividend is not reliable enough to make this a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, Force Motors has 2 warning signs (and 1 which is potentially serious) we think you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade Force Motors, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:FORCEMOT

Force Motors

An integrated automobile company, designs, develops, manufactures, and sells a range of automotive components, aggregates, and vehicles in India.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives