- India

- /

- Electrical

- /

- NSEI:EXICOM

Exicom Tele-Systems Limited's (NSE:EXICOM) Popularity With Investors Under Threat As Stock Sinks 27%

To the annoyance of some shareholders, Exicom Tele-Systems Limited (NSE:EXICOM) shares are down a considerable 27% in the last month, which continues a horrid run for the company. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

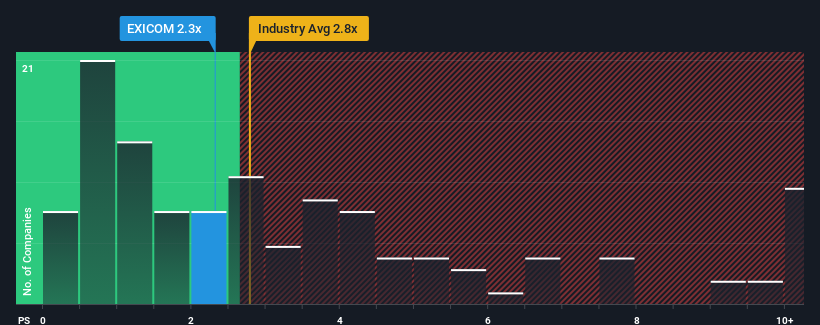

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Exicom Tele-Systems' P/S ratio of 2.3x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in India is also close to 2.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Exicom Tele-Systems

What Does Exicom Tele-Systems' Recent Performance Look Like?

As an illustration, revenue has deteriorated at Exicom Tele-Systems over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Exicom Tele-Systems, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Exicom Tele-Systems' Revenue Growth Trending?

In order to justify its P/S ratio, Exicom Tele-Systems would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.5% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 32% shows it's noticeably less attractive.

With this information, we find it interesting that Exicom Tele-Systems is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

Following Exicom Tele-Systems' share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Exicom Tele-Systems' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Exicom Tele-Systems with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Exicom Tele-Systems, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Exicom Tele-Systems, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Exicom Tele-Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EXICOM

Exicom Tele-Systems

Manufactures and sells electric vehicle chargers for residential, business, and public charging use in India and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives