Has ESAB India Limited's (NSE:ESABINDIA) Impressive Stock Performance Got Anything to Do With Its Fundamentals?

ESAB India's (NSE:ESABINDIA) stock is up by a considerable 35% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. Specifically, we decided to study ESAB India's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for ESAB India

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for ESAB India is:

24% = ₹607m ÷ ₹2.5b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every ₹1 of its shareholder's investments, the company generates a profit of ₹0.24.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of ESAB India's Earnings Growth And 24% ROE

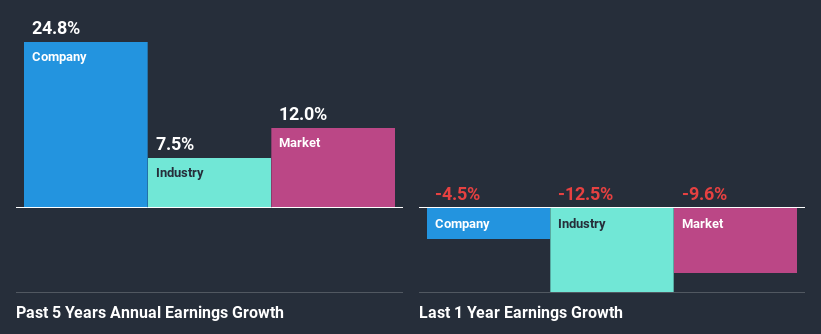

At first glance, ESAB India seems to have a decent ROE. Especially when compared to the industry average of 8.1% the company's ROE looks pretty impressive. This probably laid the ground for ESAB India's significant 25% net income growth seen over the past five years. We believe that there might also be other aspects that are positively influencing the company's earnings growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

Next, on comparing with the industry net income growth, we found that ESAB India's growth is quite high when compared to the industry average growth of 7.5% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if ESAB India is trading on a high P/E or a low P/E, relative to its industry.

Is ESAB India Making Efficient Use Of Its Profits?

ESAB India has very a high three-year median payout ratio of 151% suggesting that the company's shareholders are getting paid from more than just the company's earnings. Despite this, the company's earnings grew significantly as we saw above. With that said, it could be worth keeping an eye on the high payout ratio as that's a huge risk. You can see the 3 risks we have identified for ESAB India by visiting our risks dashboard for free on our platform here.

Additionally, ESAB India has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

In total, it does look like ESAB India has some positive aspects to its business. Namely, its high earnings growth, which was likely due to its high ROE. However, investors could have benefitted even more from the high ROE, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining hardly any of its profits. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of ESAB India's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

When trading ESAB India or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ESAB India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ESABINDIA

ESAB India

Manufactures and sells welding and cutting equipment and consumables in India.

Excellent balance sheet average dividend payer.