- India

- /

- Construction

- /

- NSEI:ENGINERSIN

Engineers India Limited's (NSE:ENGINERSIN) 32% Price Boost Is Out Of Tune With Earnings

Engineers India Limited (NSE:ENGINERSIN) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. The annual gain comes to 170% following the latest surge, making investors sit up and take notice.

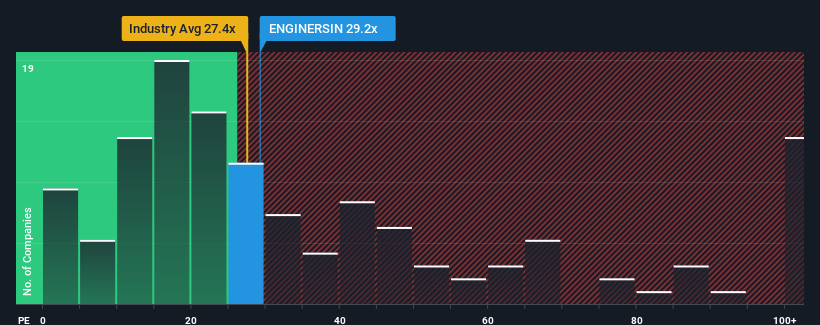

Although its price has surged higher, you could still be forgiven for feeling indifferent about Engineers India's P/E ratio of 29.2x, since the median price-to-earnings (or "P/E") ratio in India is also close to 32x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, Engineers India has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Engineers India

How Is Engineers India's Growth Trending?

The only time you'd be comfortable seeing a P/E like Engineers India's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 120% last year. The latest three year period has also seen an excellent 70% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the two analysts covering the company suggest earnings growth is heading into negative territory, declining 29% over the next year. That's not great when the rest of the market is expected to grow by 24%.

In light of this, it's somewhat alarming that Engineers India's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Key Takeaway

Engineers India appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Engineers India's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Engineers India (at least 1 which is concerning), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Engineers India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ENGINERSIN

Engineers India

An engineering consultancy company, provides design, engineering, procurement, construction, and integrated project management services for oil, gas, fertilizers, steel, railways, power, infrastructure, and petrochemical industries worldwide.

Excellent balance sheet second-rate dividend payer.