Emkay Taps and Cutting Tools Limited (NSE:EMKAYTOOLS) Soars 26% But It's A Story Of Risk Vs Reward

Emkay Taps and Cutting Tools Limited (NSE:EMKAYTOOLS) shares have continued their recent momentum with a 26% gain in the last month alone. The annual gain comes to 130% following the latest surge, making investors sit up and take notice.

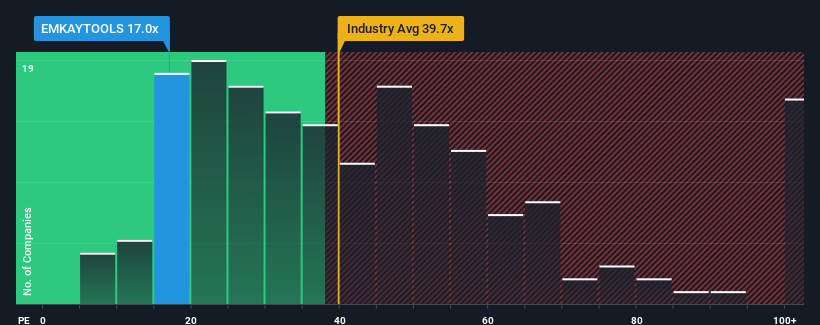

Even after such a large jump in price, Emkay Taps and Cutting Tools' price-to-earnings (or "P/E") ratio of 17x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 34x and even P/E's above 64x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Emkay Taps and Cutting Tools certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Emkay Taps and Cutting Tools

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Emkay Taps and Cutting Tools' is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 63% gain to the company's bottom line. The latest three year period has also seen an excellent 202% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 26% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that Emkay Taps and Cutting Tools is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

The latest share price surge wasn't enough to lift Emkay Taps and Cutting Tools' P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Emkay Taps and Cutting Tools revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 2 warning signs for Emkay Taps and Cutting Tools that we have uncovered.

Of course, you might also be able to find a better stock than Emkay Taps and Cutting Tools. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Emkay Taps and Cutting Tools might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:EMKAYTOOLS

Emkay Taps and Cutting Tools

Engages in the manufacture and sale of taps and cutting tools in India.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.