Earnings Not Telling The Story For Cummins India Limited (NSE:CUMMINSIND) After Shares Rise 29%

Despite an already strong run, Cummins India Limited (NSE:CUMMINSIND) shares have been powering on, with a gain of 29% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 62% in the last year.

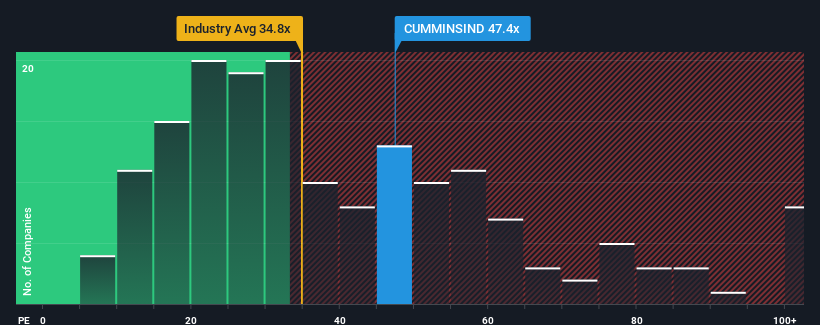

Since its price has surged higher, Cummins India may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 47.4x, since almost half of all companies in India have P/E ratios under 31x and even P/E's lower than 17x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Cummins India certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Cummins India

Is There Enough Growth For Cummins India?

In order to justify its P/E ratio, Cummins India would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 40% last year. The latest three year period has also seen an excellent 140% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 7.6% per year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 20% per annum growth forecast for the broader market.

With this information, we find it concerning that Cummins India is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Cummins India's P/E

Shares in Cummins India have built up some good momentum lately, which has really inflated its P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Cummins India's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for Cummins India you should be aware of.

If you're unsure about the strength of Cummins India's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CUMMINSIND

Cummins India

Engages in the design, manufacture, distribution, and service of engines, generator sets, and related technologies in India, Nepal, and Bhutan.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives