- India

- /

- Trade Distributors

- /

- NSEI:CROWN

Crown Lifters Limited's (NSE:CROWN) 31% Jump Shows Its Popularity With Investors

Crown Lifters Limited (NSE:CROWN) shares have continued their recent momentum with a 31% gain in the last month alone. This latest share price bounce rounds out a remarkable 490% gain over the last twelve months.

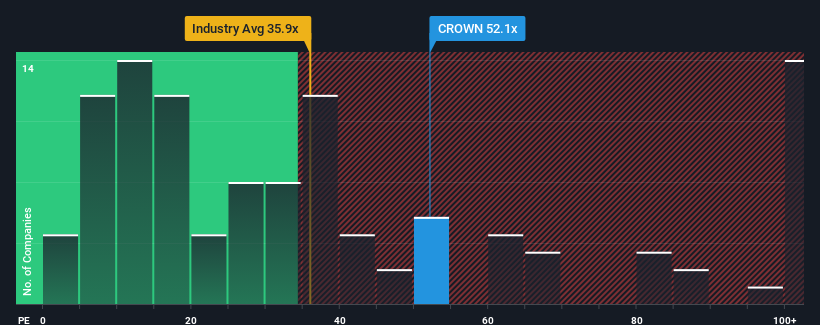

Since its price has surged higher, Crown Lifters may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 52.1x, since almost half of all companies in India have P/E ratios under 32x and even P/E's lower than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's exceedingly strong of late, Crown Lifters has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Crown Lifters

Is There Enough Growth For Crown Lifters?

In order to justify its P/E ratio, Crown Lifters would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 41% gain to the company's bottom line. Pleasingly, EPS has also lifted 113% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that Crown Lifters' P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Crown Lifters' P/E

The strong share price surge has got Crown Lifters' P/E rushing to great heights as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Crown Lifters maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Crown Lifters (1 doesn't sit too well with us) you should be aware of.

Of course, you might also be able to find a better stock than Crown Lifters. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Crown Lifters, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CROWN

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives