- India

- /

- Electrical

- /

- NSEI:CORDSCABLE

Cords Cable Industries Limited's (NSE:CORDSCABLE) 33% Share Price Surge Not Quite Adding Up

Cords Cable Industries Limited (NSE:CORDSCABLE) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. The last month tops off a massive increase of 140% in the last year.

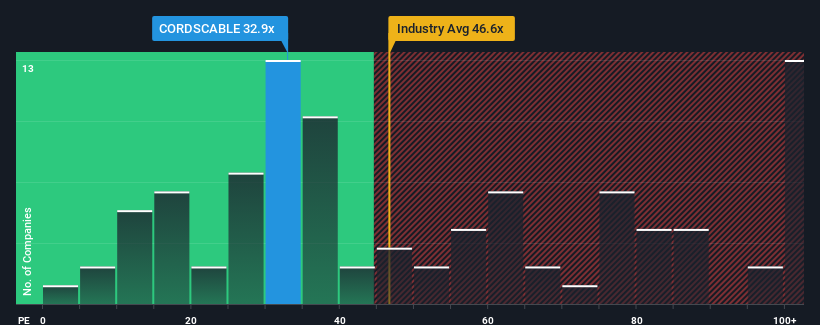

Although its price has surged higher, you could still be forgiven for feeling indifferent about Cords Cable Industries' P/E ratio of 32.9x, since the median price-to-earnings (or "P/E") ratio in India is also close to 32x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Earnings have risen firmly for Cords Cable Industries recently, which is pleasing to see. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

See our latest analysis for Cords Cable Industries

Does Growth Match The P/E?

Cords Cable Industries' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 27% last year. EPS has also lifted 28% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably less attractive on an annualised basis.

With this information, we find it interesting that Cords Cable Industries is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Cords Cable Industries' P/E?

Its shares have lifted substantially and now Cords Cable Industries' P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Cords Cable Industries currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Cords Cable Industries you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CORDSCABLE

Cords Cable Industries

Engages in the design, development, manufacture, and sale of power, control, instrumentation, thermocouple extension/compensating, and communication cables in India.

Solid track record with low risk.

Similar Companies

Market Insights

Community Narratives