- India

- /

- Construction

- /

- NSEI:CORALFINAC

Not Many Are Piling Into Coral India Finance and Housing Limited (NSE:CORALFINAC) Stock Yet As It Plummets 26%

To the annoyance of some shareholders, Coral India Finance and Housing Limited (NSE:CORALFINAC) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Looking at the bigger picture, even after this poor month the stock is up 49% in the last year.

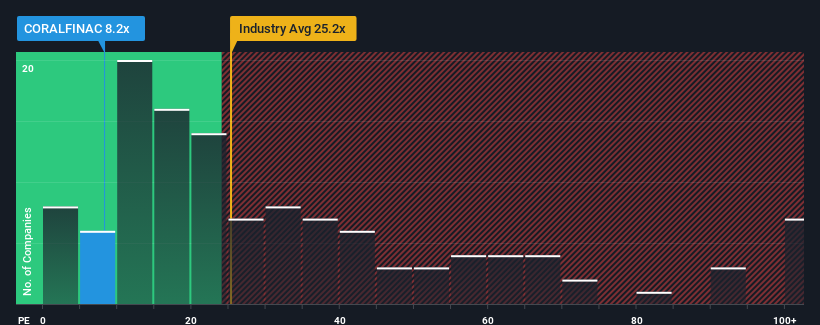

Even after such a large drop in price, Coral India Finance and Housing may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.2x, since almost half of all companies in India have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Earnings have risen firmly for Coral India Finance and Housing recently, which is pleasing to see. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Coral India Finance and Housing

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Coral India Finance and Housing would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 21%. The latest three year period has also seen an excellent 172% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 24% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Coral India Finance and Housing's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Coral India Finance and Housing's P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Coral India Finance and Housing currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Coral India Finance and Housing, and understanding these should be part of your investment process.

You might be able to find a better investment than Coral India Finance and Housing. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CORALFINAC

Coral India Finance and Housing

Provides investment services in the in India.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives