Confidence Petroleum India (NSE:CONFIPET) Will Pay A Dividend Of ₹0.10

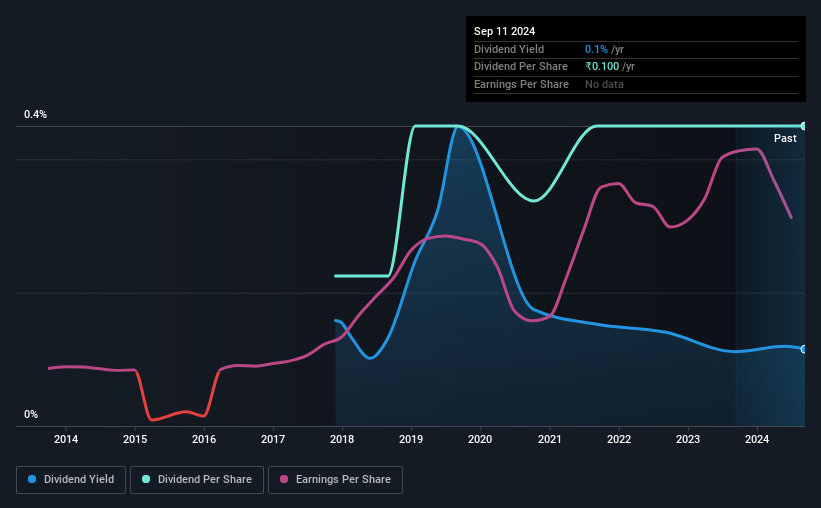

Confidence Petroleum India Limited's (NSE:CONFIPET) investors are due to receive a payment of ₹0.10 per share on 30th of October. Including this payment, the dividend yield on the stock will be 0.1%, which is a modest boost for shareholders' returns.

View our latest analysis for Confidence Petroleum India

Confidence Petroleum India's Projected Earnings Seem Likely To Cover Future Distributions

If it is predictable over a long period, even low dividend yields can be attractive. However, Confidence Petroleum India's earnings easily cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS could expand by 0.4% if recent trends continue. Assuming the dividend continues along recent trends, we think the payout ratio could be 4.3% by next year, which is in a pretty sustainable range.

Confidence Petroleum India's Dividend Has Lacked Consistency

It's comforting to see that Confidence Petroleum India has been paying a dividend for a number of years now, however it has been cut at least once in that time. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The annual payment during the last 7 years was ₹0.05 in 2017, and the most recent fiscal year payment was ₹0.10. This means that it has been growing its distributions at 10% per annum over that time. Confidence Petroleum India has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Unfortunately, Confidence Petroleum India's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. Earnings growth is slow, but on the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio.

An additional note is that the company has been raising capital by issuing stock equal to 17% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

In Summary

In summary, we are pleased with the dividend remaining consistent, and we think there is a good chance of this continuing in the future. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for Confidence Petroleum India that investors should take into consideration. Is Confidence Petroleum India not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CONFIPET

Confidence Petroleum India

Engages in the manufacture and sale of liquefied petroleum gas (LPG) cylinders in India.

Slightly overvalued with questionable track record.

Similar Companies

Market Insights

Community Narratives