After Leaping 25% Cochin Shipyard Limited (NSE:COCHINSHIP) Shares Are Not Flying Under The Radar

Despite an already strong run, Cochin Shipyard Limited (NSE:COCHINSHIP) shares have been powering on, with a gain of 25% in the last thirty days. This latest share price bounce rounds out a remarkable 685% gain over the last twelve months.

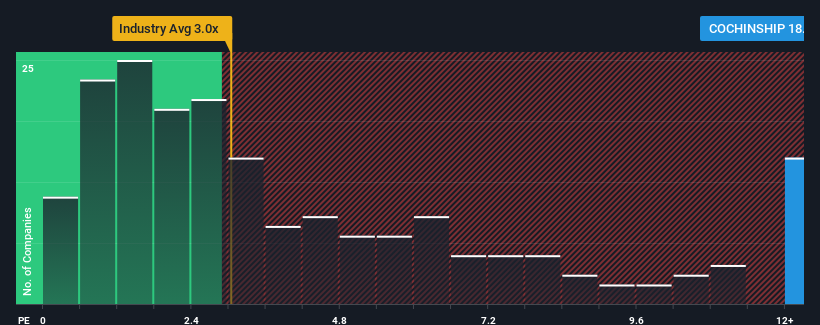

Following the firm bounce in price, when almost half of the companies in India's Machinery industry have price-to-sales ratios (or "P/S") below 3x, you may consider Cochin Shipyard as a stock not worth researching with its 18.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Cochin Shipyard

What Does Cochin Shipyard's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Cochin Shipyard has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Cochin Shipyard will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Cochin Shipyard would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 62% gain to the company's top line. Pleasingly, revenue has also lifted 36% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 15% per year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Cochin Shipyard's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Cochin Shipyard's P/S

Cochin Shipyard's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Cochin Shipyard's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Cochin Shipyard (2 are potentially serious!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:COCHINSHIP

Cochin Shipyard

Engages in the shipbuilding and repair of ships/offshore structures in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives