- India

- /

- Electrical

- /

- NSEI:CGPOWER

CG Power and Industrial Solutions Limited's (NSE:CGPOWER) 25% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, CG Power and Industrial Solutions Limited (NSE:CGPOWER) shares have been powering on, with a gain of 25% in the last thirty days. The last 30 days bring the annual gain to a very sharp 80%.

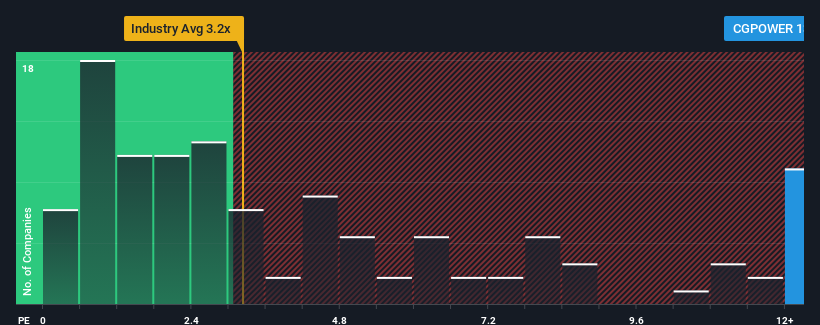

After such a large jump in price, given around half the companies in India's Electrical industry have price-to-sales ratios (or "P/S") below 3.2x, you may consider CG Power and Industrial Solutions as a stock to avoid entirely with its 13x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for CG Power and Industrial Solutions

What Does CG Power and Industrial Solutions' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, CG Power and Industrial Solutions has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think CG Power and Industrial Solutions' future stacks up against the industry? In that case, our free report is a great place to start.How Is CG Power and Industrial Solutions' Revenue Growth Trending?

In order to justify its P/S ratio, CG Power and Industrial Solutions would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. Pleasingly, revenue has also lifted 171% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 19% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 20% per annum, which is not materially different.

With this information, we find it interesting that CG Power and Industrial Solutions is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

The strong share price surge has lead to CG Power and Industrial Solutions' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given CG Power and Industrial Solutions' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

Having said that, be aware CG Power and Industrial Solutions is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CGPOWER

CG Power and Industrial Solutions

Provides various solutions in India and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives