- India

- /

- Construction

- /

- NSEI:CAPACITE

Indian Exchange Growth Leaders With High Insider Ownership And Up To 53% Earnings Growth

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained stable, while showcasing a robust growth of 45% over the past year. With earnings expected to grow by 16% annually, companies with high insider ownership can be particularly appealing as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 30.3% | 28.0% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 29.8% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 34.5% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 26.9% |

Let's explore several standout options from the results in the screener.

Capacit'e Infraprojects (NSEI:CAPACITE)

Simply Wall St Growth Rating: ★★★★★☆

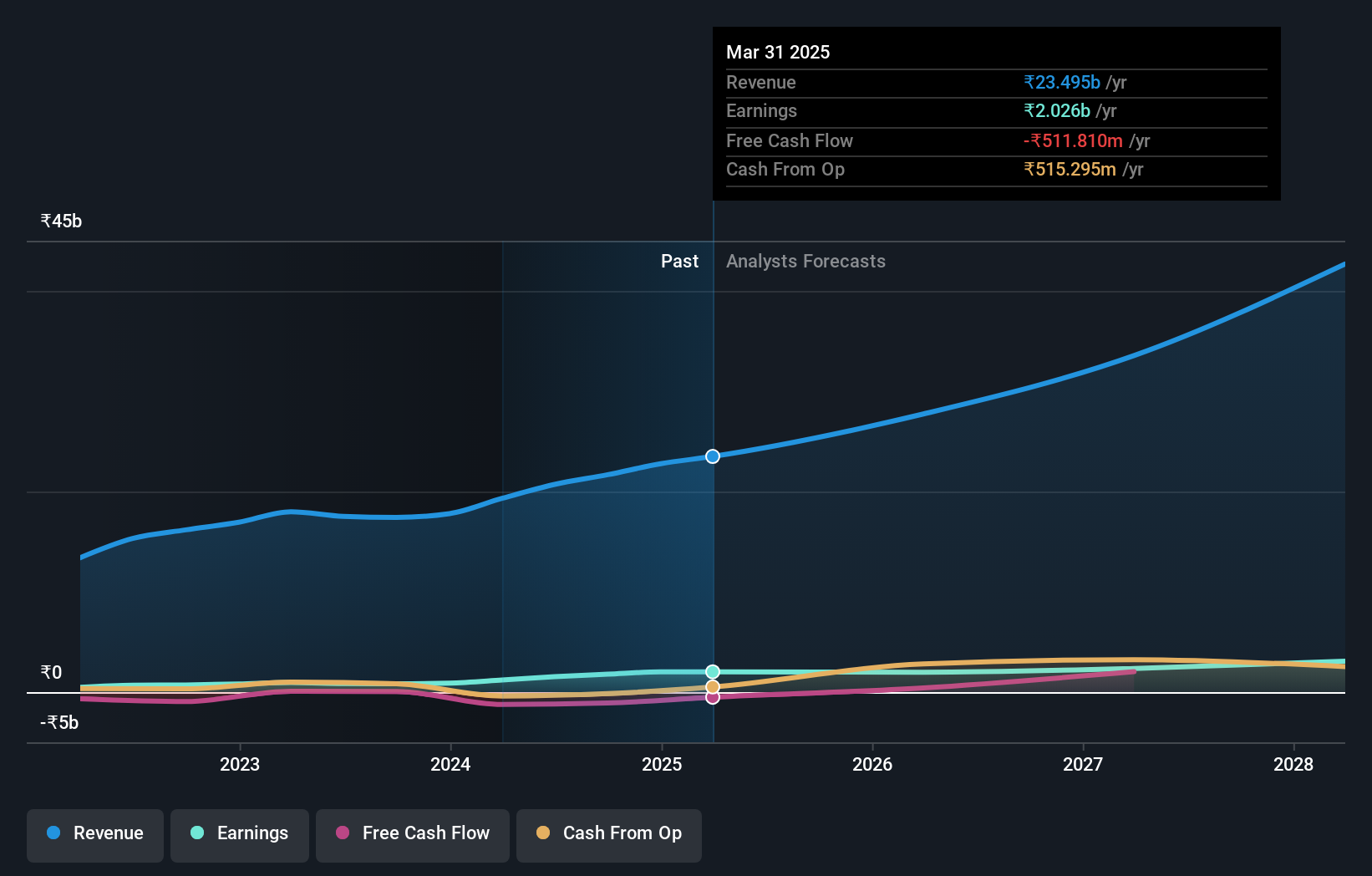

Overview: Capacit'e Infraprojects Limited operates in India, focusing on engineering, procurement, and construction services with a market capitalization of approximately ₹24.54 billion.

Operations: The company generates its revenue primarily from engineering, procurement, and construction contracts, totaling ₹19.32 billion.

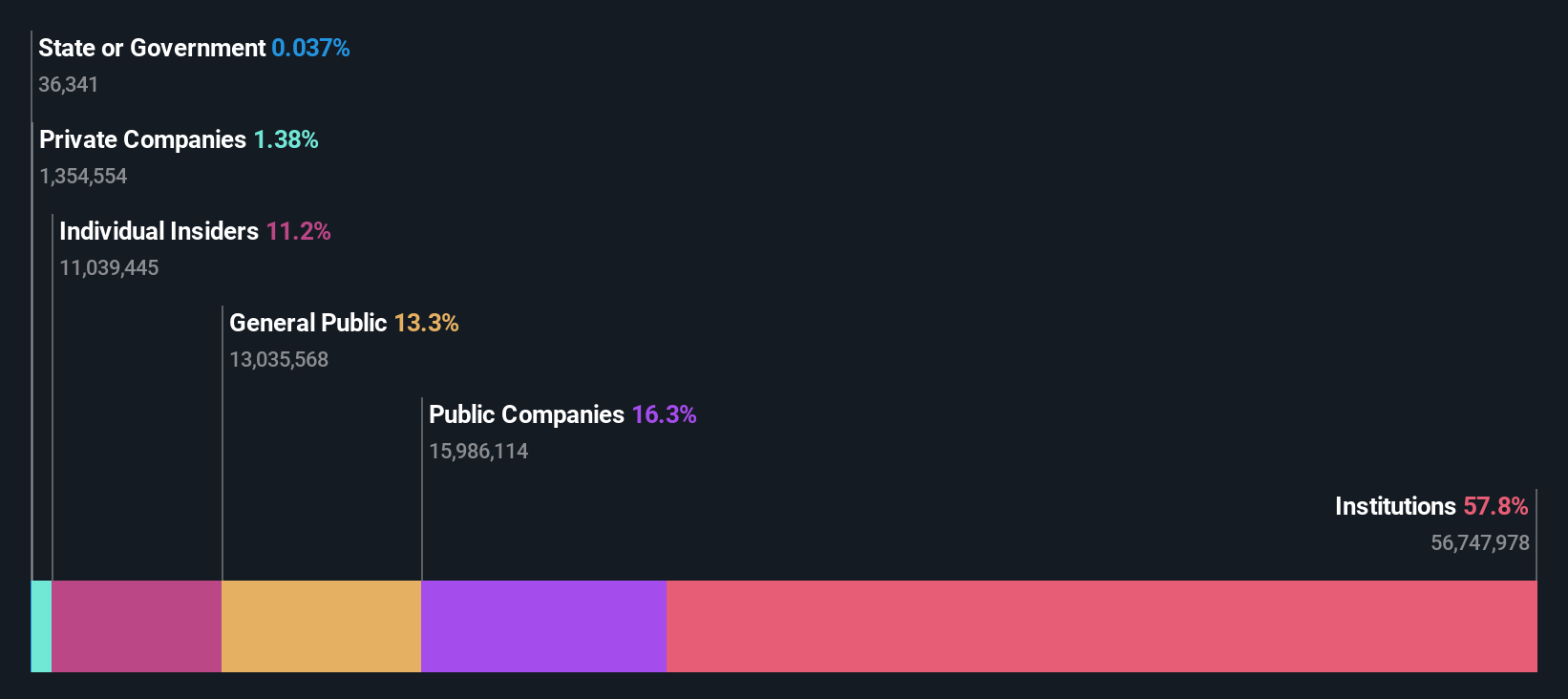

Insider Ownership: 31.4%

Earnings Growth Forecast: 24.4% p.a.

Capacit'e Infraprojects, a growth-oriented company with significant insider ownership, is trading below analyst price targets with expectations of a 29.3% price increase. Its earnings are projected to grow by 24.42% annually, outpacing the Indian market's 15.9%. Despite recent shareholder dilution and low forecasted return on equity at 11.5%, Capacit'e's revenue growth rate at 20.5% annually exceeds the market average significantly. Recent strategic moves include issuing INR 1 billion in non-convertible debentures to bolster long-term financing and leadership adjustments to strengthen governance and operational capabilities.

- Get an in-depth perspective on Capacit'e Infraprojects' performance by reading our analyst estimates report here.

- The analysis detailed in our Capacit'e Infraprojects valuation report hints at an deflated share price compared to its estimated value.

Lumax Auto Technologies (NSEI:LUMAXTECH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lumax Auto Technologies Limited, along with its subsidiaries, specializes in manufacturing and selling automotive components in India, with a market capitalization of approximately ₹39.06 billion.

Operations: The company generates revenue primarily through the manufacturing and trading of automotive components, totaling ₹28.22 billion.

Insider Ownership: 39.1%

Earnings Growth Forecast: 33.2% p.a.

Lumax Auto Technologies, with high insider ownership, has shown robust financial performance. In FY 2024, the company's revenue and net income surged to INR 28.67 billion and INR 1.30 billion respectively, indicating a strong year-over-year growth. Despite a historically unstable dividend track record, a dividend of INR 5.50 per share was proposed recently. Forecasted earnings growth is significant at 33.2% annually over the next three years, outperforming the Indian market's average of 15.9%. However, its revenue growth forecast of 14.9% annually is below the high-growth benchmark but still exceeds the market average of 9.7%.

- Click to explore a detailed breakdown of our findings in Lumax Auto Technologies' earnings growth report.

- According our valuation report, there's an indication that Lumax Auto Technologies' share price might be on the expensive side.

PVR INOX (NSEI:PVRINOX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PVR INOX Limited operates as a theatrical exhibition company, showcasing, distributing, and producing movies in India and Sri Lanka, with a market capitalization of approximately ₹143.25 billion.

Operations: The company primarily generates revenue from movie exhibition, contributing ₹60.71 billion, and other activities including movie production and distribution, adding an additional ₹3.17 billion.

Insider Ownership: 11.6%

Earnings Growth Forecast: 53.1% p.a.

PVR INOX, a key player in India's cinema exhibition sector, continues to expand aggressively with recent openings in Hyderabad and Andhra Pradesh, enhancing its luxury and technological offerings. Despite a challenging financial performance with a net loss reported in the latest fiscal year, the company is expected to turn profitable within three years. High insider ownership could indicate confidence in long-term strategies, although its return on equity is projected to remain modest. The firm’s expansion strategy and adoption of advanced cinematic technologies underscore its commitment to growth and enhancing viewer experience.

- Unlock comprehensive insights into our analysis of PVR INOX stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of PVR INOX shares in the market.

Summing It All Up

- Embark on your investment journey to our 83 Fast Growing Indian Companies With High Insider Ownership selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CAPACITE

Capacit'e Infraprojects

Engages in the engineering, procurement, and construction business in India.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives