- India

- /

- Construction

- /

- NSEI:CAPACITE

Exploring Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mix of volatility and cautious optimism, driven by policy uncertainties and fluctuating economic indicators. As investors navigate these conditions, small-cap stocks have shown both challenges and opportunities, with indices like the Russell 2000 reflecting this dynamic environment. In such a landscape, identifying promising stocks often involves looking for those with strong fundamentals and potential to thrive despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Gallantt Ispat | 15.54% | 36.20% | 40.12% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Macpower CNC Machines | NA | 22.62% | 35.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Shree Pushkar Chemicals & Fertilisers | 21.25% | 18.34% | 4.43% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

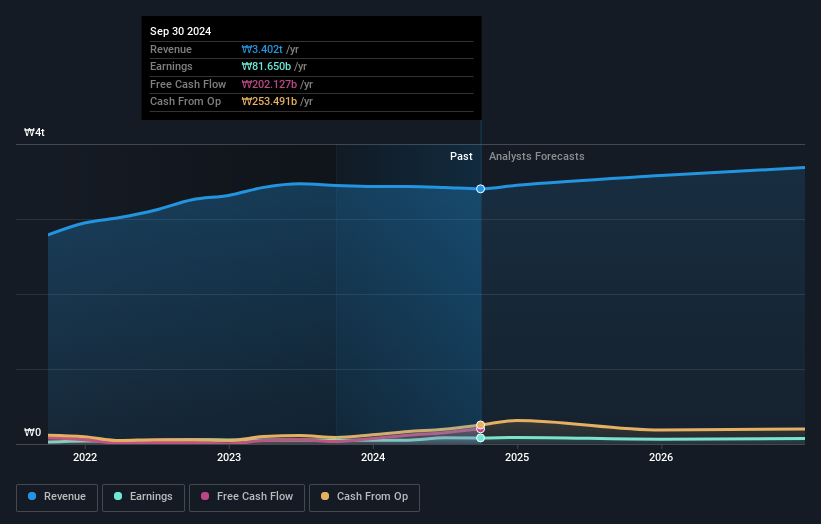

SPC Samlip (KOSE:A005610)

Simply Wall St Value Rating: ★★★★★★

Overview: SPC Samlip Co., Ltd. is a South Korean company that offers a range of food products, with a market cap of approximately ₩380.95 billion.

Operations: SPC Samlip generates revenue primarily from its Distribution Business Division, contributing ₩1.76 trillion, followed by the Bakery Business Division at ₩905.05 billion and the Food Business Division at ₩752.51 billion.

SPC Samlip is currently trading at a significant discount, 97.1% below its estimated fair value, making it an intriguing prospect. Over the past year, earnings have surged by 52.1%, outpacing the food industry's average growth of 18.6%. The company has managed to reduce its debt to equity ratio from 59.1% to a satisfactory 49.6% over five years, reflecting improved financial health. Despite these positives, future earnings are expected to decline by an average of 8% annually over the next three years, posing a potential challenge for sustained growth in this dynamic sector.

- Get an in-depth perspective on SPC Samlip's performance by reading our health report here.

Assess SPC Samlip's past performance with our detailed historical performance reports.

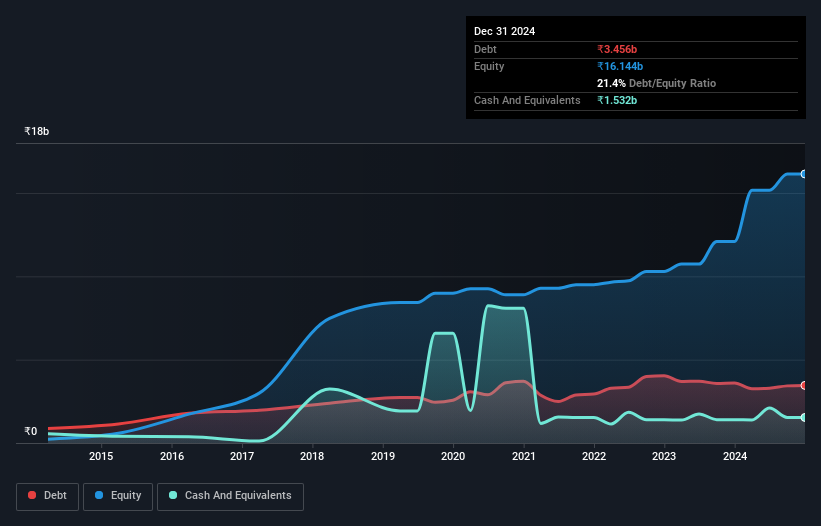

Capacit'e Infraprojects (NSEI:CAPACITE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Capacit'e Infraprojects Limited, along with its subsidiaries, operates in the engineering, procurement, and construction sector in India with a market capitalization of ₹30.67 billion.

Operations: Capacit'e generates revenue primarily through its engineering, procurement, and construction activities. The company's cost structure is influenced by project-specific expenses and operational costs. Notably, its net profit margin has shown significant variability across different periods.

Capacit'e Infraprojects, a smaller player in the construction sector, has shown impressive growth with earnings surging 114.8% over the past year, outpacing the industry's 41.4%. The company is trading at a substantial discount of 78.2% below its estimated fair value, indicating potential undervaluation. Despite recent shareholder dilution, Capacit'e's debt situation appears manageable with a net debt to equity ratio of 11.7%, and interest payments are well-covered by EBIT at 5.8 times coverage. Recent work orders worth INR 12 billion highlight strong business momentum while new leadership under CEO RK Jain could steer future strategic initiatives effectively.

I'LL (TSE:3854)

Simply Wall St Value Rating: ★★★★★★

Overview: I'LL Inc. operates a system solution business in Japan with a market cap of ¥77.72 billion.

Operations: The company generates revenue primarily from its computer services segment, amounting to ¥17.51 billion.

I'LL, a promising player in its niche, has shown robust financial health with no debt currently, contrasting with a 14.4% debt-to-equity ratio five years ago. Its earnings growth of 16.8% over the past year outpaced the Software industry average of 13.5%, indicating strong operational performance. The firm is free cash flow positive, generating US$2 billion recently and seems to be leveraging its high level of non-cash earnings effectively. With profitability ensuring no cash runway concerns and earnings forecasted to grow at 13.51% annually, I'LL presents an intriguing opportunity for those seeking growth potential in emerging markets.

- Delve into the full analysis health report here for a deeper understanding of I'LL.

Review our historical performance report to gain insights into I'LL's's past performance.

Key Takeaways

- Discover the full array of 4640 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CAPACITE

Capacit'e Infraprojects

Engages in the engineering, procurement, and construction business in India.

Undervalued with solid track record.