Blue Star Limited's (NSE:BLUESTARCO) 26% Share Price Surge Not Quite Adding Up

Blue Star Limited (NSE:BLUESTARCO) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 75%.

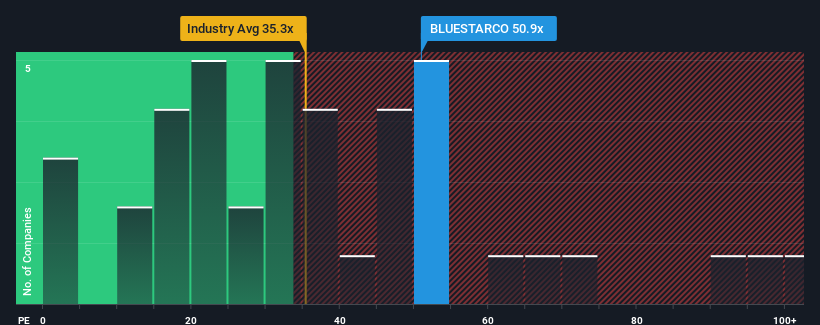

Following the firm bounce in price, given close to half the companies in India have price-to-earnings ratios (or "P/E's") below 31x, you may consider Blue Star as a stock to avoid entirely with its 50.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for Blue Star as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Blue Star

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Blue Star's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 87%. The latest three year period has also seen an excellent 984% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 14% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 19% per annum, which is noticeably more attractive.

With this information, we find it concerning that Blue Star is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Blue Star's P/E

The strong share price surge has got Blue Star's P/E rushing to great heights as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Blue Star's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Blue Star, and understanding these should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Blue Star might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BLUESTARCO

Blue Star

Operates as a heating, ventilation, air conditioning, and commercial refrigeration (HVAC&R) company in India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives